Much manifestation, not much lucidity: A few days to reflect on the possible implications of a Trump Presidency for the US, the rest of the world and the European political landscape hasn’t really done much to fill in the holes in our knowledge about what President Trump implies, relative to what Candidate Trump said .

Moreover, Anthony Scaramucci, another of Trump’s economic policy advisors sounded quite different: “We can close the wealth-gap in America by replacing emergency-level interest rates with fiscal stimulus.” That sounds like a policy that could lead to notable USD appreciation, in particular if one also considers the inflationary effects of possible protectionist policies.

While the dollar index (DXY) on the way towards 100. To my surprise there seem to be no lingering doubts as to how reliable the news we are being told by the Trump camp are.

The direct corollary of this softness in vols at higher USD index risk-reversals is the continuation of USD skew underperformance.

The climb of USDCNH to its historical highs is a perfect illustration of this dynamic since 2014: USD strengthening vs high beta currencies has tended to happen in a low vol regime, outside a few isolated exceptions (for instance: Aug 2015 CNY devaluation, Q4 2014 Oil collapse and impact on RUB, and recently AugSep MXN sell-off on US Election risk), and selling USD skews has been a consistent alpha generation strategy over the past two years.

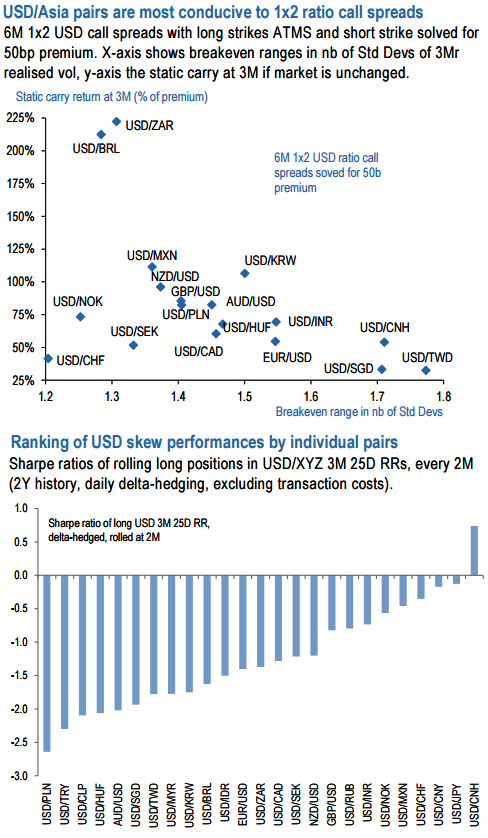

For investors looking to participate in further USD strengthening while fading rich skews, we suggest 1x2 USD call spreads for the leverage and positive carry they offer.

We emphasize and uphold 6M 1x2 ratio USD call spreads with long strikes ATMS and short strikes solved for 50bp premia, where it’s convincing that the most comfortably wide breakeven ranges are achieved by USD/Asia pairs, notably USDTWD (strikes 31.62x33.0, breakeven at 34.36 and returning max payout - 8:1), while USDKRW carries the most favorably among that group (see above chart).

On a delta-hedged basis, a breakdown of USD RRs performances at individual pair level reveals that they faced an uphill battle across the board and only (barely) performed in the pairs where market participants were actually sellers of skew (see above chart).

Indeed directional bets in the top two pairs USDCNH and USDJPY were overwhelmingly implemented in the form of call spreads and RKOs.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close