We continue to look for a lower NZD over the coming year, as tight financial conditions, weaker growth, a housing market that has peaked and a policy rate more likely to go down than up in the next year all weigh on the Kiwi.

NZD underperformed, despite a modest upside surprise from the GDT dairy auction, slipping from 81.400 to the current 78.040 levels against JPY.

The turbulence in JPY FX markets is owing to the upcoming Bank of Japan’s (BoJ) monetary policy decision, scheduled to be announced on October 31. Japan inflation ticks up in September but way off BOJ target. Prices rose 0.7 pct from a year earlier after stripping out volatile prices for fresh food, the internal affairs ministry said, buoyed by a rise in energy costs such as fuel, light and water charges.

The BoJ is likely to keep its rates and QE targets unchanged at its 31 October MPM. The BoJ's stubbornly dovish stance leaves JPY as a preferred funding currency. However, NZDJPY volatility should come from speculative comments by Japanese central bank.

OTC Outlook

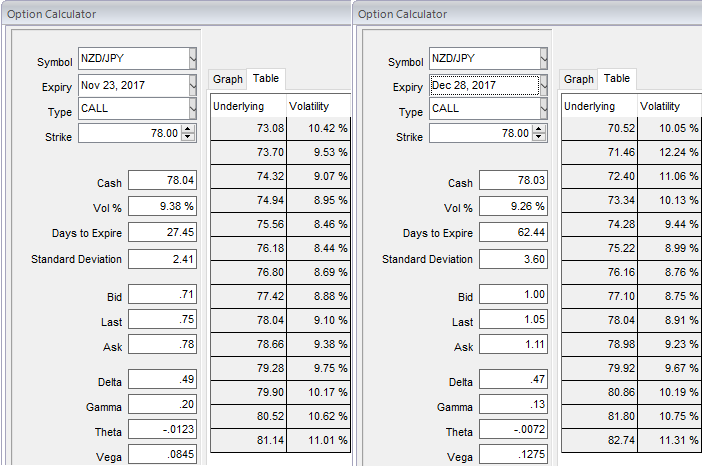

ATM IVs of NZDJPY is trading between 9.26% and 9.4% for 1 and 2m tenors respectively.

Please also be noted that the options with a higher IV cost more which is why in this case OTM puts have been preferred over ATM instruments. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good. When you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

Option Strategy:

Thus, conservative hedgers can prefer the below strategy:

Debit Put Spread = Go long 2M ATM -0.49 delta Put + Short 1m (1%) OTM Put with lower Strike Price with net delta should be at -0.40.

For a net debit, bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright.

However, put options have a limited lifespan. If the underlying FX price does not move below the strike price before the option expiration date, the put option will expire worthless.

Aggressive bears can bid NZDJPY 1m IVs & RR to buy 75 NZDJPY OTM put of near-month tenors.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 21 levels (which is neutral), while hourly JPY spot index was at shy above 83 (bullish) at the time of articulating (at 04:23 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise