The US 10yr Treasury yields rose from 2.25% to 2.33%, and 2yr yields rose from 1.36% to 1.39%. Fed fund futures yields firmed slightly, pricing the chance of a December rate hike at around 47%.

Ahead of today’s FOMC’s meeting for the decision on funds rates, although we could see a choppy range of US dollar index for the day, some sort of bearish sensation is lingering. At present, the large majority of market participants are expecting the FOMC’s plan not to work out. That explains the current USD weakness. After its meeting today the FOMC will send out only a few signals that will convince the market of the contrary. The Fed has been amongst the central banks relying on interest rate normalization for some time.

On the flip side, RBNZ Assistant Governor McDermott spoke a few minutes ago on economic trends and its inflation target, with comments on the neutral cash rate (3.5%, which means 1.75% is stimulatory), inflation (sideways trend in core), and the exchange rate (lower would help).

Once again, we have raised the forecast profile for the NZD, as the local rates market keeps questioning the RBNZ’s commitment to its low-for-long stance and USD softness persists.

But we still expect the NZD to fall through this year, reaching USD0.67at year-end. It is hard to disagree with the central bank’s argument that the bounce in inflation to above 2%oya is tradable driven and unlikely to persist.

Even if there were an argument for much tighter financial conditions, they are already being delivered through the macro-prudential and bank funding cost channels, pushing the neutral OCR lower.

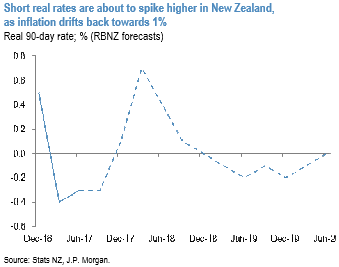

We expect that an ongoing repricing of the NZD front end through 2017 will weigh on the NZD, but some near-term support from rising real rates (as headline inflation falls over 1.0%-pts in the year to March 2018) must also be acknowledged (refer above chart).

NZ: trade balance for July expected to be a surplus, helped by lower imports.

NZDUSD technical trend sends early signs of a possible top ahead of 0.7485 (Sep 16 peak). Plenty of event risk today from McDermott, AU CPI, Lowe, and FOMC.

The RBNZ has signaled the next cycle – a tightening one – will not start until the end of 2019. That will anchor the short end, although markets will not abandon their expectations for tightening as early as mid-2018 which would mean occasional spikes in the 2yr will be likely. A 2yr swap range of 2.10% - 2.60% is expected. The long end will continue to follow US yields, which we expect to rise by year end.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch