Predictably, the issues should dominate this week are that the meetings of the major central banks, namely the Fed, the ECB and the BoJ. The ECB meeting, in particular, should be interesting, as the QE exit will be on the agenda. We expect dovish accompanying signals and do not share the general market euphoria about the alleged beginning of the end of the unconventional ECB policies.

There are positive signs from Italy, where the new government seems to be more interested in a sound fiscal policy than initially feared. Finance minister Giovanni Tria, in particular, sounded quite cautious over the weekend. “More generally, we will not accept measures which, even unintentionally, could cause financial instability.” This might be a quote by Wolfgang Schäuble. This is sufficient for the FX markets to trade the euro stronger. The Italy-induced mini-crisis is over and already forgotten.

A 6% sell-off in the rear view mirror does not make for ideal entry levels into fresh Euro shorts, yet it has to be acknowledged that political and cyclical drags on the currency have the capacity to extend in coming weeks, and a setback in EURUSD towards 1.14 is not entirely out of the realms of possibility should remaining EUR spec length on IMMs be washed out in coming weeks (EUR loses its bearings in the Italian storm).

We propose creating conditional bearish EUR exposure via long/short pairs of EUR puts as low/no premium ways of positioning for an extension of the ongoing sell-off while sidestepping the risk of an abrupt bullish turn in price action.

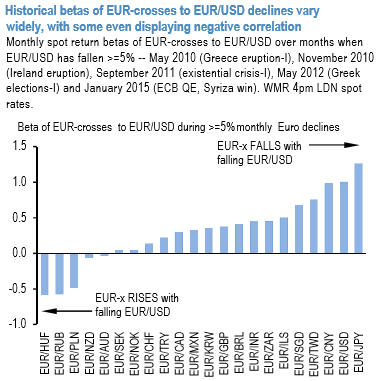

Conditional trades require a pair of assets whose expected relative returns are under-estimated by their relative option prices. EUR-crosses offer a rich universe to scan for such opportunities since they vary widely in their responsiveness to broad EUR shocks which increases the odds of finding jointly-mispriced pairs.

The above chart illustrates the point by plotting the historical spot return betas of EUR pairs to EURUSD during months of sharp Euro declines (defined as monthly EURUSD return <= -5%, constituting a 2 sigma fall). While concerted Euro-weakness can and does drag most of the bloc lower (mostly positive EUR betas), a handful of currencies – EURHUF, EURRUB, EURPLN, EURNZD and have all registered significant declines over the past few weeks

Based on a scan of current pricing of options across the two ends of the beta spectrum, the following strikes us as fairly-priced near zero-cost combination:

Buy EUR puts/USD calls vs. sell a 50:50 basket of EUR puts/NZD calls and EUR puts/NOK calls, 2M 2% OTMS strikes on all legs for net 9bp of EUR notional on the EURUSD leg, versus 41bp on the EURUSD option standalone.

EURNZD is the favored short over EURAUD given the more overt dovish lean of the RBNZ, while a mix of existing spec length and any potential moderation in oil prices can help tame downside in EURNOK. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index has shown 92 (which is bullish), while hourly USD spot index was at 82 (bullish) while articulating at 11:06 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms