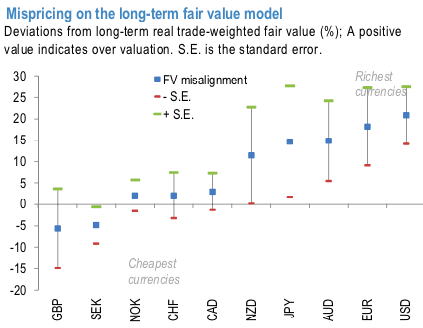

Despite substantial FX market moves over the past month, the ranking of currencies on this framework has hardly changed. GBP and SEK remain cheap, while USD, EUR, and the Antipodeans remain at the rich end of the spectrum (refer 1stchart).

Crude prices are inching down today (at around $51.60), to pare yesterday’s strong gains.

Over the past month, JPY, SEK, and GBP have outperformed within G10, while the Antipodeans have underperformed the most. AUD continued to trade on the back foot, breaking resuming bearish sentiment at 0.7212, currently trading as low as 0.7173 before spongy gains to 0.7210 as the yuan eased. NZD has slid back from 0.6848 to the current 0.6771 levels.

Despite these moves, GBP and SEK remain cheap on this framework. The dollar has weakened over the past month but still screens rich overall. JPY which was already rich to begin continues to screen rich on this framework.

Among the underperformers, Antipodeans are still on the richer end of the spectrum, as is JPY. Given the recent Antipodean underperformance, the overshoot of these currencies on this framework has declined.

However, despite this move, these two currencies continue to be the richer relative to the G10 petro-FX (refer 2ndchart).

Despite the recent weakening, USD continues to screen 21% rich on the framework, keeping it the richest G10 currency on a cross-sectional basis. Current mispricing indicates that two-way risks to the currency. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly AUD spot index is at -52 (bearish), GBP spot index is inching towards 33 levels (which is mildly bullish), hourly USD spot index trending at 64 (bullish) and NZD is at -113 (bearish) at press time (14:03 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures