Gold -

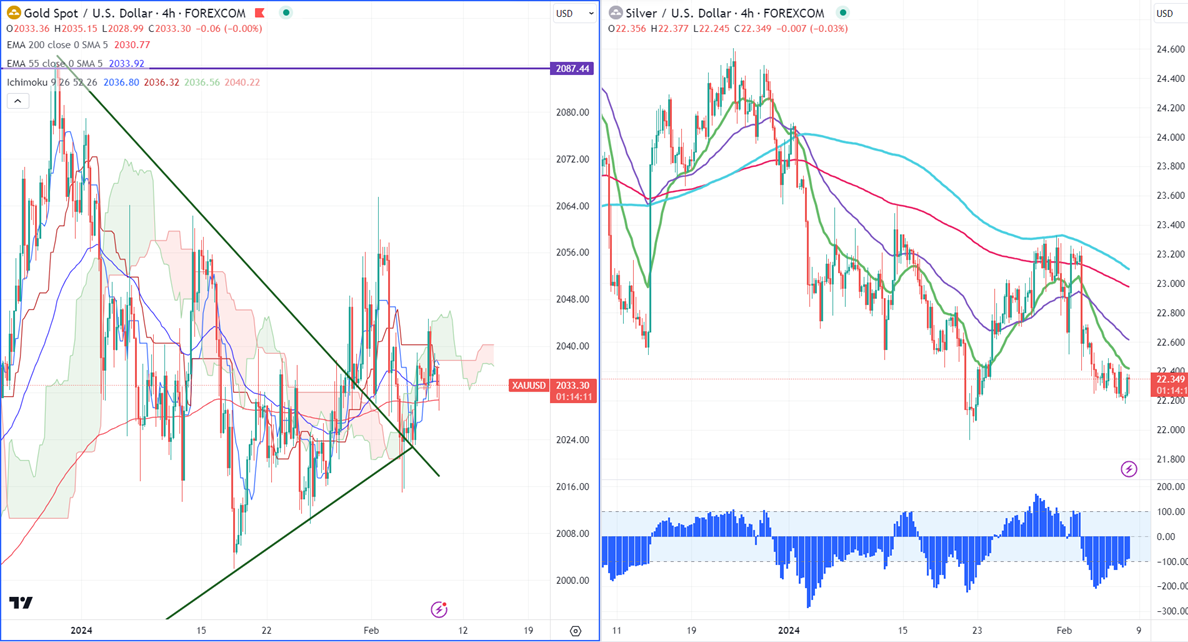

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $2030.95

Kijun-Sen- $2040.22

Gold trading with no direction for the past three days. Fed Reserve Governor Adriana Kugle and the Fed Minneapolis President cautioned about an early rate cut because of a fall in inflation. The yellow metal hit a low of $2028.99 at the time of writing and is currently trading around $2031.24.

According to the CME Fed watch tool, the probability of a no-rate cut in Mar increased to 81.50% from 45.5% a week ago.

US dollar index- Bullish. Minor support around 103.50/102.75. The near-term resistance is 104.60/106.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $2025, a break below targets of $2015/$2000/$1970/$1956. The yellow metal faces minor resistance around $2045 and a breach above will take it to the next level of $2060/$2070/$2080/$2100.

It is good to buy on dips around $2000 with SL around $1970 for TP of $2065/$2080.

.

Silver-

Silver consolidates in a narrow range between $ 22.48 and $22.19 in this week. It trades below 21, 55- EMA, and 200 EMA in the 4-hour chart. The near-term resistance is around $22.50 and a break above confirms an intraday bullishness. A jump to $22.75/ $23/$23.35 is possible. On the lower side, immediate support is around $21.90, any violation below will drag the commodity to $21.40/$20.68.

Crude oil-

WTI crude oil prices recovered slightly despite weak US crude inventory data. According to EIA, US crude inventory rose by 5.5M barrels, compared to a forecast of 1.5M.

Major resistance- $75/$78. Significant support- $70/$68.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays