Gold -

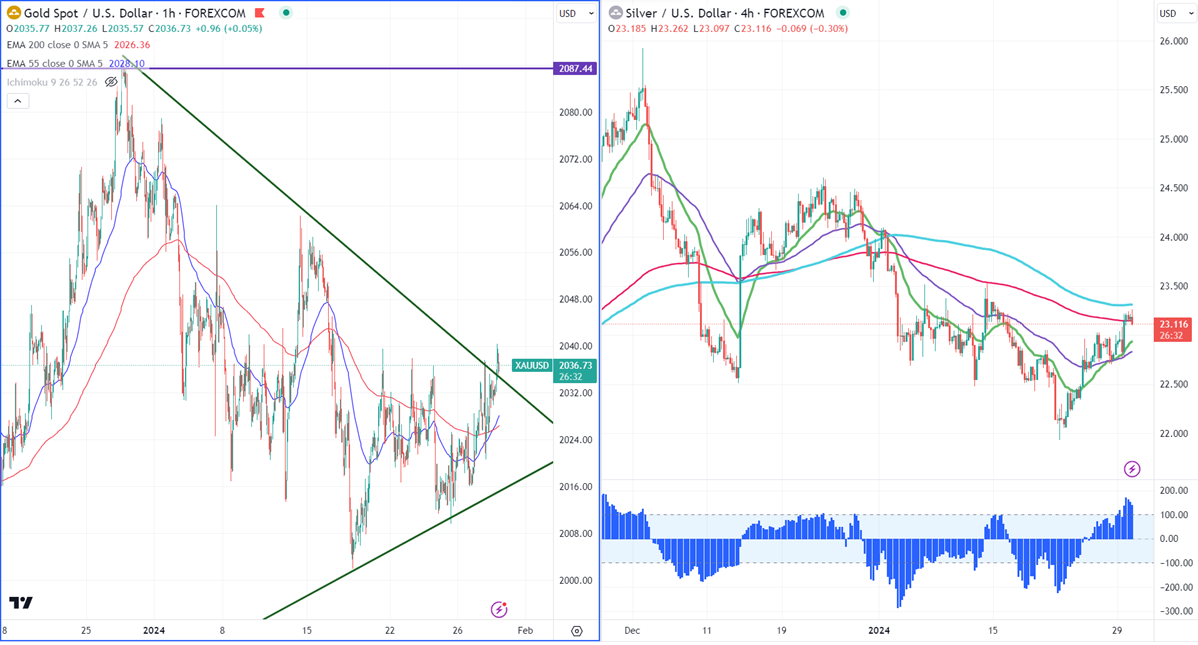

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $2021.27

Kijun-Sen- $2023.75

Gold trades higher despite the strong US dollar. The escalation of geo-political tension in the Middle East has increased the demand for safe-haven assets like Gold. The yellow metal hit a high of $2040.40 at the time of writing and is currently trading around $2036.68.

According to the CME Fed watch tool, the probability of a no-rate cut in Jan increased to 97.9% from 96.90% a day ago.

US dollar index- Bullish only if it closes above 103.69 (200-day EMA). Minor support around 103/102.75. The near-term resistance is 103.75/104.50.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - Mixed (Neutral for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $2030, a break below targets of $2015/$2000/$1970/$1956. The yellow metal faces minor resistance around $2040 and a breach above will take it to the next level of $2050/$2062/$2078.

It is good to buy on dips around $2015 with SL around $2000 for TP of $2065/$2080.

.

Silver-

Silver showed a minor profit booking after a jump to $23.26. It is facing significant resistance at $23.25 (200-day EMA) and nay close above confirms a bullish continuation. It trades above 21 and 55- EMA and below long-term MA (200- EMA) in the 4-hour chart. Any close above $23.25 (200-day EMA) will take the pair to $23.60/$24 is possible. It is facing immediate support at around $22.80. Any break below target $22.50/$21.90/$21.50.

Crude oil-

WTI crude oil prices pared some of its gains on weak Chinese economic data. But the downside is limited due to the escalation of geo-political tension in the Middle East.

Major resistance- $80/$83.50. Significant support- $77/$74.

Jan 30th, 2024, CB Consumer Confidence (3 pm GMT)

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data