Gold -

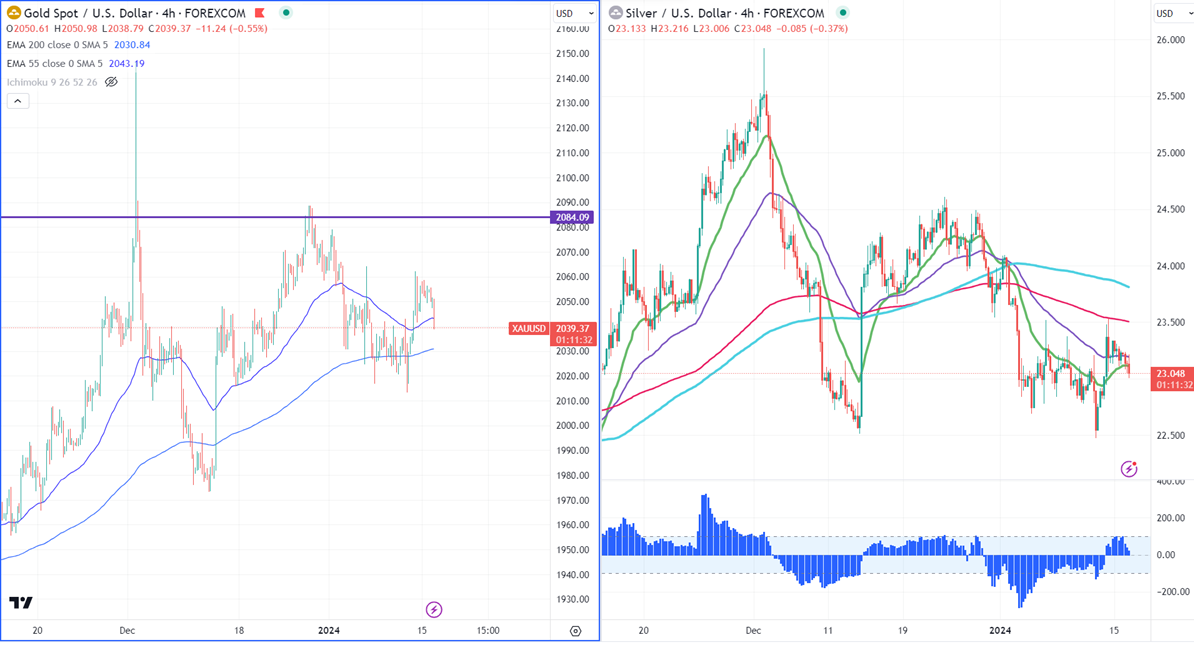

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $2033.64

Kijun-Sen- $2041.46

Gold pared most of its gains on board-based US dollar buying. The US dollar index gained momentum after upbeat US CPI data. US headline CPI rose above estimate to 3.4% YoY. US PPI fell 0.10% in Dec, compared to a forecast of 0.10%. Core PPI came unchanged at 0% vs the forecast of 0.20%. It hit a low of $2038.79 and is currently trading around $2040.07.

According to the CME Fed watch tool, the probability of a no-rate cut in Jan increased to 95.3% from 94.80% a week ago.

US dollar index- Bullish. Minor support around 101.80/100.60 The near-term resistance is 103.25/104.

Factors to watch for gold price action-

Global stock market- Mixed (Neutral for gold)

US dollar index - Bullish (Bearish for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $2035, a break below targets of $2024/$2010/$2000. The yellow metal faces minor resistance around $2050 and a breach above will take it to the next level of$2060/$2070/ $2090/$2100/$2150.

It is good to buy on dips around $2030 with SL around $2010 for TP of $2150.

Silver-

Silver facing strong significant resistance around 200-4H EMA at $23.53. The precious metal trades below 21 and 55- EMA and long-term MA (200- MA) in the 4-hour chart. Any break above $23.55 (200-4H EMA) confirms minor bullishness. A jump to $24/$24.50. It is facing significant support at $22.50 Any close below $22.50 targets $21.80/$21.

Crude oil-

WTI crude oil prices gained slightly despite the strong US dollar. The escalation of the Middle East supports the oil price at lower levels.

Major resistance- $75.35/80. Significant support- $71/$68.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential