The sharp appreciation of CNH was a major development in FX markets this week. Coming on the heels of a change in the PBoC's daily USD/CNY fix mechanism the previous Friday, markets seem to have interpreted these moves as signalling a regime shift in FX policy in favor of RMB appreciation, or at the very least, an end to the controlled depreciation strategy of the past two years.

A more modest pace of spot moves should calm realized vols and have a dampening effect ATMs, while weaker spot vs. vol correlations should prevent risk-reversals from slipping further into negative territory.

Beyond the issue of a directional regime shift, there is also a legitimate debate on the implications of the new fixing mechanism for the equilibrium value of CNY volatility. The bull case is that a previously transparent basket-based formula for the fix has turned more opaque due to the introduction of a discretionary counter-cyclical factor, and the risk premium for this incremental unpredictability ought to be reflected in option prices.

The second issue is that the new strong FX policy, if that is indeed what this is, seems to be inconsistent with the broader macro narrative of deleveraging and structural growth slowdown with attendant outward pressure on capital flows, and hence potentially subject to durability risk if financial stability regulation over-tightens domestic financial conditions. The bear argument is that absent broad USD strength that militates against Chinese policy preferences, a strong CNY bias should be inherently vol reducing in line with longstanding spot-vol directionality.

Also, PBoC fixing mini-regimes dating back to the pre-basket days have typically tended to last between 3-6 months, so it is too early and expensive to mull any change/reversal/U-turn, especially given the widely broadcast goal of Chinese authorities to maintain macro stability in the lead-up to the November plenum. Even in the event of an unanticipated global risk shock over the next few months, the counter-cyclical adjustment lever can allow the PBoC to reprise its crisis playbook of flat-lining the fix and sap any realized volatility at the front-end of the vol curve. It is also worth recalling that the pre-basket fix era was associated with consistently sub-2% 1M ATM vol, so current levels of 3.6 appear on the rich side even if full convergence to the old regime does not occur.

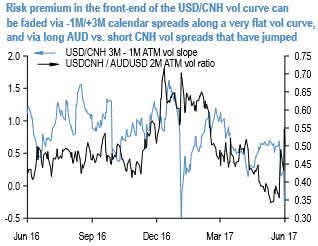

We are more sympathetic to the second camp of a contained front-end vol argument over coming weeks, and like expressing it in pure volatility format by

i) selling 6-wk vs. buying 3M vega-neutral straddle calendar spreads that provide short gamma exposure and take advantage of vol curve flatness (vol indic. 0.1/0.15), and

ii) AUD/USD vs. USD/CNH 2M vol spreads in weighted vega notional to fade the spike in their implied vol ratio (refer above chart) while partially hedging against the economic fallout of ongoing credit tightening.

That the latter is impacting Chinese activity was visible in the disappointing May manufacturing PMI print, and the AUD’s sensitivity to both China growth risks and a less cheerful domestic backdrop makes it one of the best short risk/long vol candidates in our book. Frontend AUD vol is also an excellent outright buy in its own right given bargain basement implied vol levels (even by the standards of a generally depressed asset class) and nearly non-existent implied/realized premia.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says