After a particularly gruelling week last week, G10 cyclical currencies rebounded this week (in still-illiquid conditions) to retrace over 5% vs USD on average. CAD, however, was a notable laggard, improving only 2.4% against the dollar.

This to us reflects an increasing awareness of Canada’s precarious economic situation, above and beyond the indiscriminate carnage that COVID-19 is laying upon countries worldwide. This was highlighted more clearly this week when Suncor, a large oil-sands producer, opted to temporarily shut down some production in the wake of local oil prices dropping to single digits. This is one of the key macro risks specific to Canada that we've been flagging, and is suggestive of particular pain in coming months on top of the likely huge contraction in the services sector. Canada’s current account deficit meanwhile is large but the basic balance remains negative, meaning that a deep or extended contraction could see a drying up of financing flows.

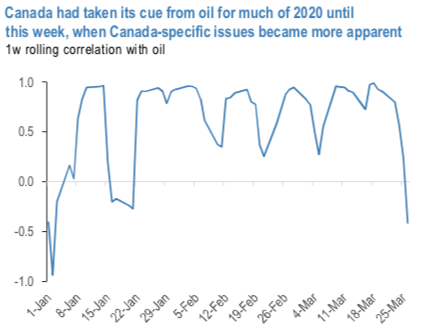

Given these concerns, it makes sense that CAD has decoupled from oil this week as the focus on Canada's specific weaknesses grows larger (refer 1st chart). Despite the move lower in USDCAD this week, we maintain that directionality from here is higher in the pair.

Hence, add longs in USDCAD via options contemplating above fundamental factors and below OTC indications:

The fresh negative bids are observed to the existing bullish risk reversal setup that indicates the mild price dips, while the hedging sentiments for the upside price risks (refer 2nd chart).

While the positively skewed IVs of 3m tenors are indicating the upside as well as upside risks (3rd chart).

Hence, at this juncture (when spot reference: 1.4134 level), we upheld our shorts in CAD on hedging grounds via 2-month (1.3920/1.4350) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CAD recommendations. Courtesy: Sentry, JPM & Saxobank

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data