Well.., a little price revival from last couple of days would not mean that previous downtrend has ended. Instead, they are to be regarded as resurgence rallies and could be utilized by deploying short term put writings that is likely to derive certain returns on every rally.

The prime purpose of employing shorts of (1.5%) in the money puts are serving, (see daily charts), this was recommended on 16th of this month and these lesser tenor shorts would have expired worthless and no longer be in the money.

Refer our previous post: http://www.econotimes.com/FxWirePro-Capitalize-on-NZD-JPY-rallies-to-deploy-shorts-in-put-ladder-for-hedging-103917

We see now is the time for those active long positions in ATM and OTM puts.

Here are the ways in which one can build and develop put ladders regardless of swings. That In-The-Money puts on short side in strategy were always at risk of exercise, but you have nothing worry about this now as they've expired worthless.

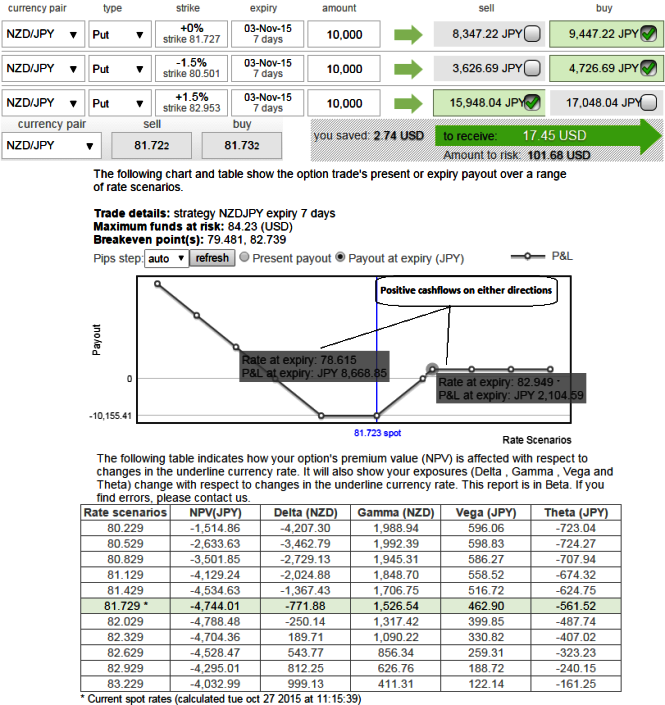

Keeping maximum tenor on long side and time decay advantage:

The pair is likely to perceive implied volatility close to 14.56% which is inching lower from 17%, holding 2 lots of ATM and OTM put with longer expiry since implied volatility is inching lower which is good for option holders.

We've seen in the last post, using shorter tenor contracts on short side has helped us options expiring worthless and lock in profits, conversely, in the same way let us keep maturity a bit lengthier on longs.

Giving a longer time to expiration for long sides so as to make a substantial move on the downside so that assignment can be covered by the long puts like opposite to the time decay and implied volatility work in your favor on the short sides.

FxWirePro: Capitalize NZD/JPY put ladder on rallies – longs to hedge resumption of bearish trend

Tuesday, October 27, 2015 6:56 AM UTC

Editor's Picks

- Market Data

Most Popular

8