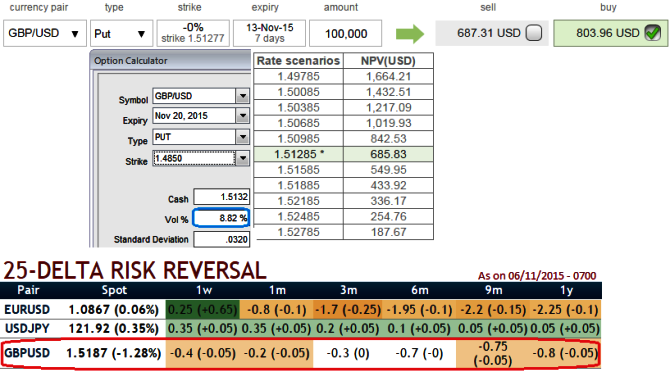

Delta risk reversal indicates downside hedging has been costlier.

While GBPUSD Spot FX is at 1.5135,

NPV of ATM Puts is 685.83, premiums are trading 17.22% higher than NPV at USD 803.96 with IV at 8.20%.

2% OTM put (strike at 1.5748) = 8.82%.

Hence, pondering over the range bounded trend but slightly downswings, FX OTC market sentiments for this pair we recommend shorting near month futures with a stop loss at 1.5456 for target at 1.5415, thereby observed risk reward ratio at 0.64.

The cable's implied volatility of ATM is still perceived to be the least within next 1w-1m time frame in major G7 space (at around 6-7%), you can observe implied volatilities from historical basis.

Thus, the risk reversals of ATM contracts of 1 month maturities have no significant disparities between at the money and out of the money instruments.

On hedging grounds, at spot FX levels of 1.5135 we advise staying long in 2w 1% out of the money -0.27 delta put while shorts in 1w 1% in the money put with positive theta values.

The above risk reversals compare the volatility paid/charged on out of the money calls versus out of the money puts and it also gauging weaker market sentiments ahead of significant NFP data. An aggressively out of the money (OTM) option is often seen as a speculative bet/hedge that the currency will move sharply in the direction of the strike price.

For a net debit bear put spread reduces the cost of hedge by the premium collected (on the shorts of ITM put) and keeps hedger to participate on upward moves but it comes at the expense of Partial hedge rather than a complete hedge.

FxWirePro: Cable weakness deepening as risk reversals indicate downside risks - buy debit put spread for hedging

Friday, November 6, 2015 12:43 PM UTC

Editor's Picks

- Market Data

Most Popular