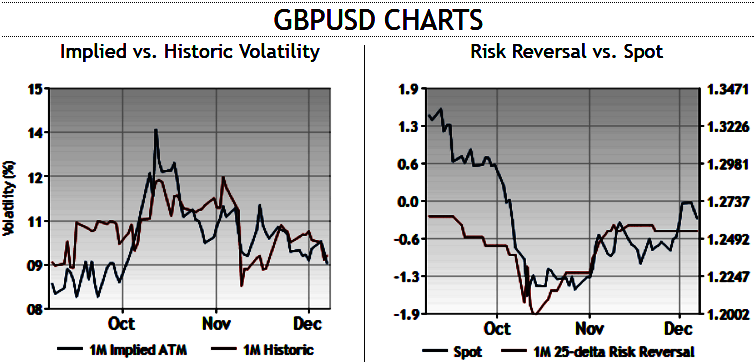

Please be advised that the 25-delta risk of reversal of GBPUSD has not been indicating any dramatic shoot up nor any slumps (no fresh change in risk reversals has been observed), but seems to be one of the pairs to be hedged for downside risks as it indicates puts have been relatively costlier.

The risk reversal curve has been traveling in a linear direction, while spot curve is slumping downwards back to converge with the RR curve.

GBPUSD’s range bound pattern is still persisting but some bearish candles are indicating slight weakness on both weekly and monthly charts, (Ranging between upper strikes 1.2730 and lower strikes at around 1.2082 levels.

We could still foresee this range bounded trend to persist in near future but little weakness on weekly charts is puzzling this pair to drag southward targets but very much within above stated range.

Hence, we could only speculate this pair with reducing vols soon after BoE meeting that is scheduled next week. GBPUSD interim bulls drift in sideways, major downtrend still remains intact.

The cable volatility surface has returned to levels seen at the start of the year overall, but risk reversals and butterflies are now excessively cheap: - The sell-off in the cable skew is exaggerated compared to ATM volatility, since the risk remains asymmetric on the downside; - The tail risk is mispriced, as the GBP/USD butterfly is now less expensive than the EUR/USD butterfly, which is unsustainable given the GBP extra tail risk.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data