Chart and candlestick pattern formed- Shooting stars repeatedly at 88.634, 88.129 and 88.629 levels respectively (refer weekly plotting). These bearish patterns are followed by 3-black crow pattern which is again a serious bearish indication.

As a result, the bears have managed to breach below rising wedge baseline that has acted as the strong support so far in the intermediate trend (on weekly plotting).

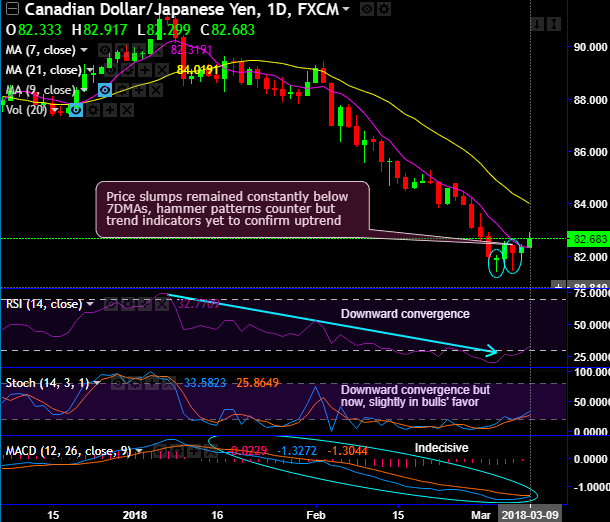

However, hammer pattern has occurred on daily plotting that counters this price slump for now.

On the broader perspective, shooting stars have occurred even on monthly terms at 87.251 and 88.649 levels. Thereafter, the steep slumps that have broken strong supports at 84.578 (7EMA) in the recent past signal weakness (refer weekly plotting), the major bearish trend has now resumed after shooting stars formation on this timeframe, both leading & lagging indicators substantiate.

On this time frame, both RSI and stochastic curves have constantly been converging downwards to selling interests that confirms the strength and momentum of the bearish trend.

To substantiate this bearish stance, the trend indicators (MACD, 7 & 21EMAs on weekly terms) have also been showing bearish crossovers that signal downtrend to prolong further.

Trade tips:

Contemplating both short and intermediate trend observations, it is wise to buy tunnel spreads binary options strategy with upper strikes at 82.986 levels and lower strikes at 82.032 levels, with this leveraged product one can add magnified impact on the trade yields if the underlying spot FX keeps dipping but remains above lower strikes on expiration.

Alternatively, one can also deploy shorts in futures contracts of mid-month tenors with a view to arresting further potential slumps.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying shy above 94 levels (bullish), while hourly JPY spot index was at -109 (bearish) while articulating (at 06:01 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit: