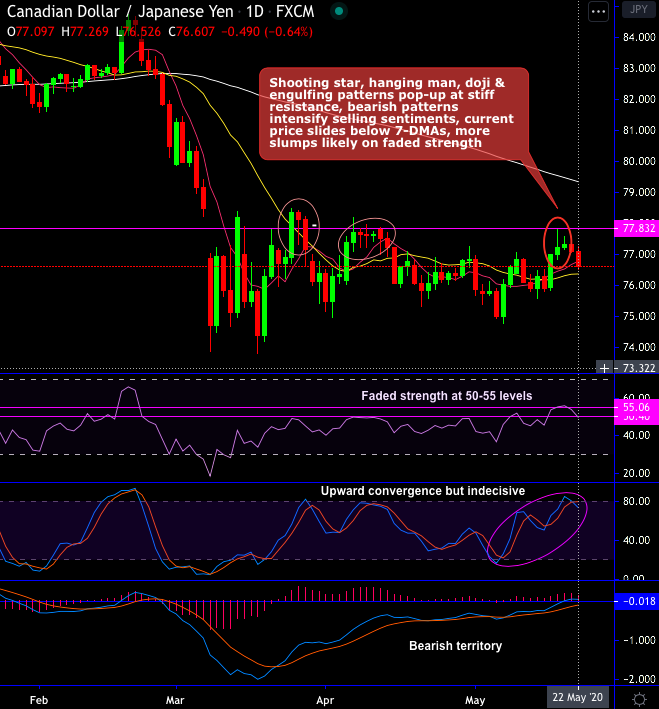

CADJPY resumes bearish swings on failure swings at the stiff resistance zone of 77.832 levels.

Shooting star, hanging man, doji & engulfing patterns pop-up at stiff resistance, consequently, bearish patterns intensify selling sentiments (refer daily chart).

The current price slides below 7-DMAs, more slumps likely on faded strength signalled by the leading oscillators.

On a broader perspective, the major downtrend looks robust on head & shoulder pattern, 7, 21 & 100-EMA may restrain the interim upswings.

The major downtrend, that was in the consolidation phase since December 2015, has been signalling weakness again upon breach below the neckline of head & shoulder pattern (refer monthly terms).

Head at 91.638, left shoulder at 88.922, right shoulder at 87.219 and neckline at 80.544 levels. Shooting star pattern pops-up at that juncture to hamper previous bullish momentum on this timeframe.

Ever since the formations of shooting star and bearish engulfing patterns at 84.120 and 82.819 levels respectively on monthly plotting, we witnessed steep slumps thereafter. Overall, the major trend seems to be weaker both momentum oscillators (RSI & Stochastic curves show downward convergence to the prevailing slumps) and bearish EMA & MACD crossovers are in bears’ favor.

Trade tips: Well, upon above technical rationale we recommend trading via boundary options using upper strikes at 77.269 and lower strikes at 75.742 levels. One can derive certain yields as long as the underlying spot FX remains between these two strikes on expiration.

Alternatively, we advocate, at spot reference: 76.585levels, shorting futures contracts of mid-month tenors on hedging grounds, as the underlying spot FX likely to retest southwards at 74 levels in the medium terms. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.