Technically, this pair is bearish bias for the day as the last week’s bull swings seem to have given up the last week’s momentum when the pair tested resistance at 113.501 levels, while the prices on monthly chart consistently rejected through inverse saucer to push further downside. Price behaviour has been hovering at this level from 3-4 sessions (see 4H chart), while the prices on monthly chart consistently rejected at inverse saucer to push further downside.

On the other hand, 1m IV skews, risk reversals still indicate the bearish hedging sentiments in the FX OTC markets but IVs are equally conducive for both option holders as well as for writers.

From these risk reversal numbers, the hedging framework can individually be tailored, structured to mitigate the risk associated with the FX exposures. You can define:

Option-trade recommendations:

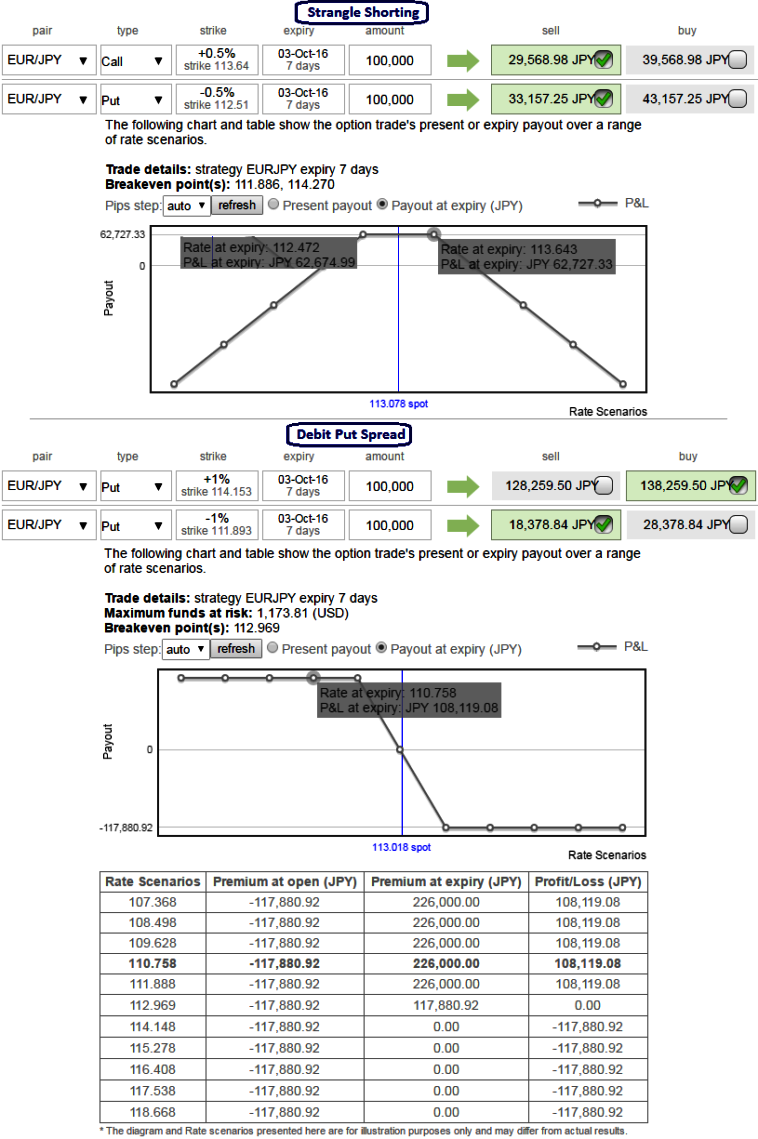

- Writing a strangle

For those whose foresee non-directional that is existed in this pair from the last couple of months or so to prolong in reducing IV scenario, prefer to remain in the safe zone, we recommend shorting a straddle considering IV shrinks.

Thereby, one can benefit from certain returns by shorting both calls and puts.

Thus, short 7D (1% OTM striking) put and (1% OTM striking) call simultaneously of the same expiry (preferably the short term for maturity is desired).

The strategy is likely to derive the maximum returns as long as the EURJPY spot FX price on expiry is trading between 112.472 and 113.643 levels only as both the instruments have to wipe off worthless. So that the options trader gets to keep the entire initial credit taken as profit.

- Bear/Debit Put Spread (BPS):

As the risk appetite varies from different investors to different traders, we’ve customized our formulation of strategies for such varied circumstances.

On a hedging perspective, the foreign trader who are aggressively expecting slumps, debit put spreads are advocated as the selling indications are piling up on daily graph. So buying In-The-Money Puts and to reduce the cost of hedging by financing this long position, selling an Out-Of-The-Money put option is recommended.

We’ve shown how a typical debit put spread resembles like and its payoff structure, one can deploy such strategies if you are bearish on this pair but want to play it safe. The strategy is likely to generate positive cashflows as long as it keeps evidencing more slumps.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data