Bearish sterling scenarios:

1) The UK growth slows below 1% as consumers are squeezed by inflation and falling house prices.

2) Outright capital repatriation from slower moving long-term investors including central banks.

3) Initial Brexit talks flounder on the size of the UK's exit-bill.

Bullish Sterling scenarios:

1) The govt pursues a lengthy transitional deal with the EU which maintains the trade status quo for 2-3 years.

2) The economy rebounds to 2.0-2.5%.

3) 2-3 MPC members dissent for tighter policy at the Aug MPC/QIR,

4) Current a/c deficit shrinks below 2%.

Snap rallies and add gamma puts bidding mounting RR and skews to hedge GBPUSD:

Please note that the nutshell above showing the positive shift in delta risk reversals of GBP has to be fairly interpreted, net risk reversals have still been indicating downside risks but interim rallies in the weeks to come.

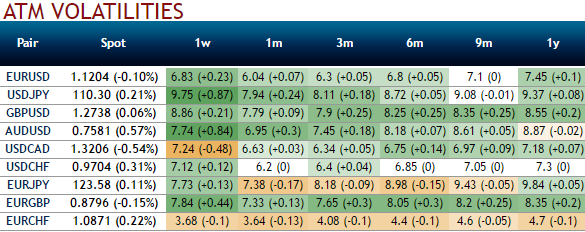

While spiking IVs on a higher side of longer tenors with positively skewed IVs still signify the hedgers’ interest for OTM put strikes.

Mounting negative delta risk reversal can be interpreted as the opportunity for put longs as the market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Hence, we advocate weighing up above aspects in below option strategy, we eye on loading up with fresh vega longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

The aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility.

Further GBPJPY weakness and/or abrupt upswings suggest building a directional and volatility patterns at the same time: the value of OTM puts would likely to rise significantly as the IVs seem to be favoring these distant strikes. We, therefore, recommend shorting 2w IVs and buying IV skews of 2m tenors.

As a result, we believe in jacking up in long leg of the below option strategy:

Initiate longs of 2 lots of 2m at the money gamma put options, simultaneously, short 1 lot of (1%) out of the money put of 2w expiry with positive theta. It is advisable to prefer European style options.

We’ve chosen Gamma instruments on long leg because Gamma is the rate of change of the Delta with respect to the movement of the rate in the underlying spot FX market. In the Sensitivity table, Gamma shows how much the Delta will change if the underlying rate moves by 1%, thus the hedger would be in a position to ascertain how much of his FX exposure is effectively hedged.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise