European central bank is lined up for monetary policy meeting on 12th September, following the ECB’s surprisingly dovish message in the recent past. For the eurozone, we have lowered our forecast for 2020 from 1.1% to 0.7% as Germany remains in the grey zone between lean growth and recession. The looming protracted economic slowdown suggests more than ever that the ECB will adopt a comprehensive easing package at its next meeting in September. The ECB should lower its deposit rate from -0.4% to -0.6%, introduce a tiered interest rate system to relieve banks of the penalty interest rate and resume net purchases of bonds.

The euro is likely to suffer from the fact that the ECB will resume its net purchases of bonds. We have therefore lowered our year-end forecast for EURAUD from 1.68 to 1.6550.

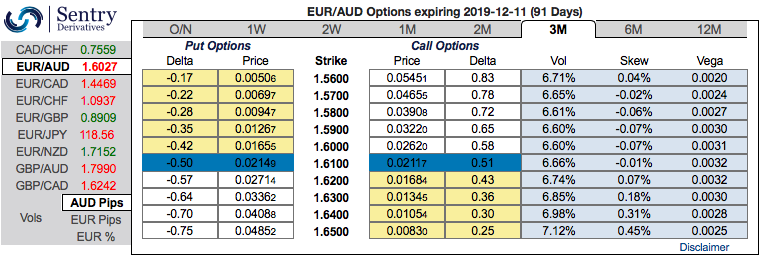

OTC Indications and Options Strategy: Please be noted that IV skews of EURAUD are stretched on either side, the positively skewed IVs of 3m tenors are signifying more hedging interests in bullish than bearish risks. More bids for OTM calls of this tenor indicate that the underlying spot FX likely to spike up to 1.65 levels and bids for OTM puts show 1.56 levels.

Contemplating fundamental and OTC factors as explained above, although it is sensed that all chances of Aussie dollar looking superior over Euro in the near term and vice versa in the medium-term future; accordingly, we advise to hedge the puzzling swings through below options recommendations.

The execution: Spot reference: 1.6026 levels, buy 2 lots of at the money 0.51 delta call option of 3m tenor and simultaneously, buy at the money put option of 1m tenors. The option strap is more of a customized version of straddles but instruments slightly biased bullish risks.

Alternatively, on hedging grounds, we advocated directional hedging strategy, we foresee significantly less upside for EURAUD in the near term, the pair could probably show slumps further in the near term.

Hence, it is wise to initiating shorts in EURAUD futures contracts of Sept’19 delivery as further downside risks are foreseen and simultaneously, longs in futures of Oct’19 delivery for the major uptrend. Thereby, one can directionally position in their FX exposures. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately.Courtesy: Sentrix & Commerzbank

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data