Ahead of the key US policy rate decision next week, the August reading of CPI inflation is due today. Although this is not the Fed’s preferred inflation measure, it nevertheless provides a first indication in how inflation evolved last month.

More generally, we expect headline inflation to rise gradually over time, but it is sufficiently contained for now to enable the Fed to put off a rate hike until December. The data indicated that the Fed is likely to leave interest rates unchanged at its next meeting, which is scheduled for September 20-21.

The risk-on sentiment and hunt for yield that prevailed in the past few months, benefiting emerging-market assets, was based on a belief that central banks were going to provide more stimulus as the Fed stands pat.

Since the bears in Gold have wiped off buying interest, for now, the price has been tumbling consecutively from the last couple of days and on the Comex division of the NYME, gold futures for December delivery were steady at $1,318.50.

Hedging Framework:

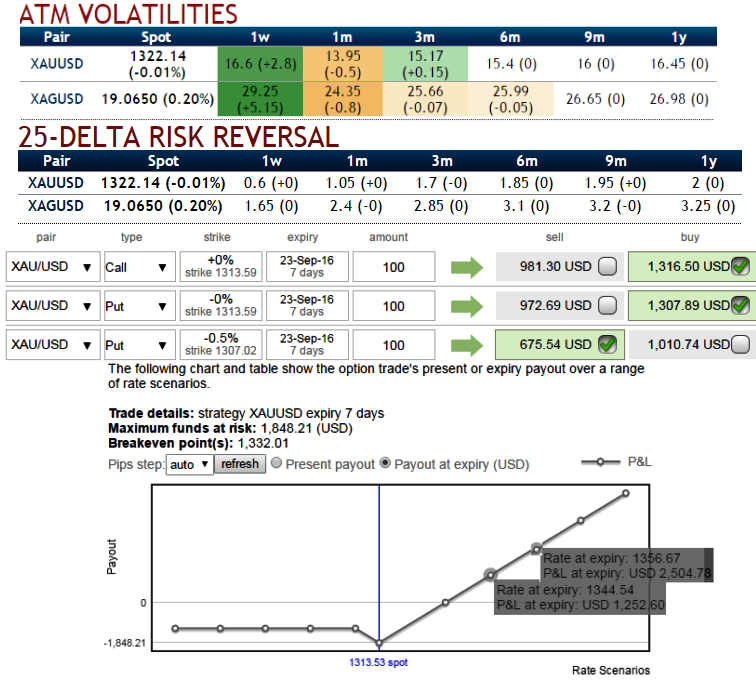

The implied volatility of 1W XAU/USD ATM contracts - 16.6% and 13.95% for 1m tenors.

While, risk reversals are still signalling upside risks, considering above fundamental developments in bullion markets we think the opportunity lies in writing an OTM put while formulating below strategy for gold's fluctuation at this juncture.

3-Way Options straddle versus Put

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Bidding short term risk reversals with writing 1W OTM put contracts,

As stated above, since Fed in next week’s monetary policy likely to maintain status quo in its funds rate, bullion market may gain momentum on safe-haven demand sentiment would be strengthened.

So, shorting expensive puts with shorter expiries would reduce the cost of ATM straddles.

How to execute:

Go long in XAU/USD 2M At the money delta put, long in 4M at the money delta call and simultaneously, Short 1M (1%) out of the money put with positive theta.

Please be noted that the tenors chosen in the diagram are just for demonstration purpose only, use appropriate tenors as stated above.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data