Gold’s rallies have been eventful trading sessions in the recent past to wrap-up 2018 (almost over 4.77% spike in the last month), gold price in the major trend has gone into the consolidation phase.

Technically, the major trend resume consolidation phase after the formation of hammer patterns at the double top neckline (refer monthly plotting). As a result, the current price on this timeframe, has spiked above EMAs with most likely bullish crossover. Both RSI and stochastic curves, also converge upwards to the upswings.

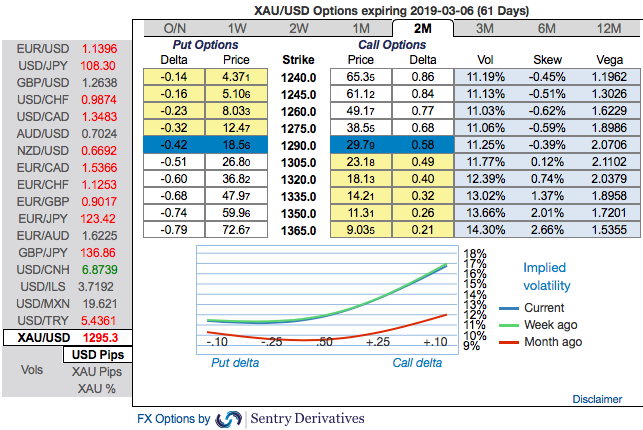

Bullish neutral risk reversals are observed in gold’s OTC hedging market, while positively skewed IVs of 2m XAUUSD options have been stretched out on either side.

This is interpreted as the mounting hedgers’ bids for OTM calls options.

Well, on hedging grounds, keeping topsy-turvy underlying sentiment under consideration, XAUSUD ATM straddles are advocated, while the strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 1m tenors at net debit with a view of arresting potential FX risks on either side.

On trading perspective, bidding bullish neutral risk reversals, buying (1%) in the money gold call options are advocated, an in the money call with a very strong delta would move in tandem with the underlying XAUUSD move.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 37 levels (which is bullish), while articulating (at 05:38 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025