Bulls in bullion markets have had a gala time during New-Year and mounting geopolitical risks in the recent past. Price gains of the precious yellow metal considerably from last 2-3 days (especially from X’mas season to New-Year) has extended the major uptrend. But this week, these price gains have been pared with profit booking sentiments. From last 2 days, the bears managed to plummet prices from the peaks of 1611.27 level to the recent lows of 1540.08 level (i.e. -4.4%), Today, it is drifting in sideways.

Risk assets continued to rally on Thursday, as fears over tensions in the Middle East continued to ease following President Trump’s comments about Iran seemingly “standing down” on Wednesday. Oil prices were flat, as was the Oslo Stock Exchange, while the NOK traded mostly sideways. Safe government bonds in Europe sold off and yields nudged higher, with the German 10-year yield currently trading at -0.18%. US yields were flat on the day and the dollar strengthened.

Barring mainland Chinese equities, Asian bourses are mostly trading higher this morning, with moves and FX and rates markets subdued as investors await the US employment report this afternoon. We could foresee more upside risks in the months to come amid minor price dips in the short-run.

OTC Updates:

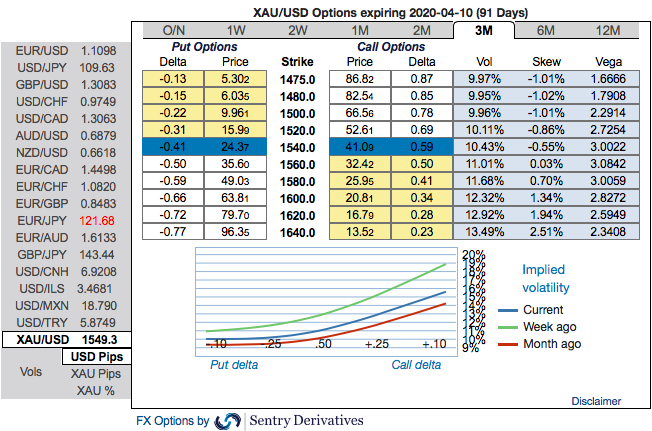

The 3m positive skewness of options contracts of gold implies more demand for calls (refer 1st chart). These skewed IVs of 3m XAUUSD contracts are still indicating the upside risks, hedgers’ bid for OTM call strikes up to $1,640 is quite evident. One could also see the fresh bids for the existing bullish risk reversal setup. To substantiate the above-mentioned dubious bullish sentiment, risk reversal (RRs) numbers also indicate the overall bullish environment (2nd nutshell). Well, we know that options are predominantly meant for hedging a probable risk event in future.

Hedging Strategy:

Capitalizing on all the above fundamental drivers and OTC indications, we advocate longs in gold via ITM call options as they look to be the best suitable at this juncture.

Thus, we still advocate buying 3m XAUUSD (1%) ITM -0.69 delta calls on hedging grounds. If expiry is not near, delta movement wouldn’t be 1-point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying.

Alternatively, on hedging grounds, we advocated long positions CME gold contracts of 2019 deliveries. We now wish to maintain the same strategy by rolling over the contracts for March’2020 delivery as we could foresee more upside risks and intensified buying interests on safe-haven sentiments amid geopolitical turmoil and the global financial crisis. Courtesy: Sentry and Saxobank

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings