The sterling has been particularly subtle to Brexit developments over the last few months. In last month, the EU determined that ‘sufficient progress’ had been made on divorce-related matters - which included coming to a financial settlement in the region of £35-40bn, no hard border between Northern Ireland and the Republic of Ireland and agreeing on the rights of EU citizens – allowing discussions to move onto the nature of the future trading relationship.

Initial statements from Brexit Secretary Davis and EU Chief Negotiator Barnier have highlighted how negotiations could yet test the unity of both sides. Davis has suggested that the UK is aiming for a ‘Canada plus plus’ deal, adding that the intention through negotiations is to treat goods and services as ‘inseparable’.

However, Barnier has already outlined that there will be no ‘special’ treatment for the UK financial services sector. Interestingly, the Bank of England has indicated that it will not be changing the rules for EU banks operating in London, even in the event of a ‘no deal’. While the risk of a disorderly Brexit has fallen, it nevertheless remains a key risk factor for EUR GBP in particular.

The fundamental motivation for owning GBP volatility was colored by uncertainty on multiple fronts – around the Brexit process, increasingly dysfunctional domestic politics, continued debate around the abrupt change in the BoE’s reaction function and the risk of an unwind of rate hikes priced along the yield curve should growth and/or politics intercede.

While implied and realized vols have collapsed over the past month following the tentative political agreement on a stand-still two-year transition period once the UK leaves the EU next March. But the more important issue – the nature of the UK’s new trade arrangement with the EU – remains to be determined, and as such, there is scope for fresh instability around the Brexit process this year, even if the process looks relatively free of drama for the next few months. Meantime, we remain to be convinced that prosaic economic fundamentals are conducive to a stable, low volatility recovery in the pound.

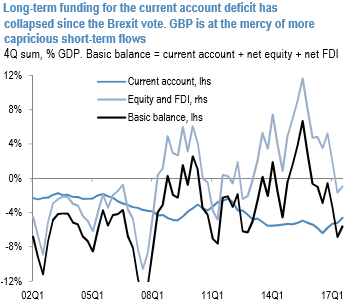

The economy is chronically underperforming the Euro area (in this sense Brexit is already exerting a palpable drag on the economy) and the UK’s current account deficit, which is still of the order of 4.5% of GDP, is now entirely reliant on short-term funding as inflows of equity and FDI into the UK have collapsed following the Brexit vote (refer above chart). This creates a potentially unstable backdrop for GBP and increases the sensitivity of the pound to future BoE policy. Courtesy: JPM

Trade recommendation: Long a 1Y vol swap in EURGBP. Initiated at 8.85%. Marked at 7.00%.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?