We believe that BoJ has shifted its monetary policy stance in last monetary policy meeting (MPM), however, any decisions by the central bank at the next MPM (including some “surprises” discussed above) would be unlikely to play a role of game changer, unless the bank (and the government) implements the regime shift in “helicopter money policy”.

As was seen in January when USDJPY rally ignited by the surprising BoJ decision to introduce NIRP lasted only for three days, given the current condition, where JPY’s fundamentals are solid (e.g. increased current account surplus).

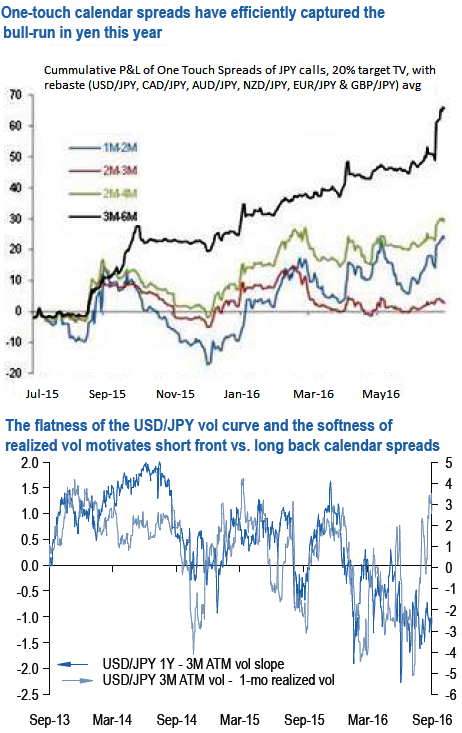

Elsewhere, on grounds that the vol curve is inverted in the 3M-1Y sector and that ex-BoJ day realized vols are soft compared to ATMs (below chart, 3M ATM 11.65 vs. ex-BoJ realized vol 10.5).

This class of trades has worked well for us this year given the persistent flatness of the yen curve, and we have often exploited the set up via one-touch calendar spread which is also a genuine directional alternative to straddle calendars in this instance.

The above chart explains that such structures have performed well in capturing the yen’s bull run this year, and function best on a basket of yen-crosses for short 3M vs. long 6M tenors.

Applied to USDJPY, this would suggest short 3M 94 vs. long 6M 94 one-touches that cost 13% to buy in equal USD notionals, and roll up to 25% in 3- months time should spot remain around current levels i.e. static carry gains of roughly 100% of the upfront premium.

The hope, of course, is to thread the needle by virtue of gentle yen appreciation over the next three months that stops short of breaching 95 – possibly as intervention concerns come to the forefront – and can lead to 2X-5X returns on upfront premium depending on terminal spot levels.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close