The BoJ’s consumer inflation rose by 0.1 pct in December. This came in as expected but lower than Novembers 0.2 pct rise. The BOJ began publishing its own consumer price calculations in November 2015 to better understand the underlying price trend. Its index strips away volatile fresh food and energy but includes processed and imported food prices.

The Japanese central bank startled the market today by raising its buying in 5-10y bonds, trying to keep the 10y JGB yields near zero. This move comes after the central bank unexpectedly skipped widely anticipated bond-buying operations in shorter maturities, which and pushed JGB yields higher.

Markets now wait to watch the decision of the BoJ at its 2-day monetary policy meeting, scheduled to be held on January 30-31. We foresee that the central bank will remain committed to holding its 10y JGB yields near zero while keeping interest rate steady at -0.10 pct.

Against that, the NZ economy is strong and dairy prices have risen, but these forces are subservient to the US dollar’s trend.

The RBNZ ended its easing cycle on 10 Nov and will remain on hold for a long time. Inflation pressures are not evident and short end pricing seems unwarranted. The long end free continues to follow offshore yields and curve steepening trends should continue.

OTC updates and hedging framework:

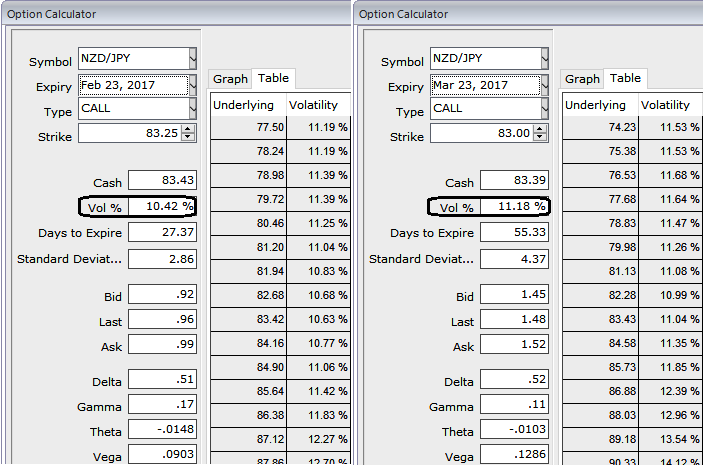

Please be noted that the 1m IVs are trading at around 10.42%, while 2m IVs are around 11.18%.

In NZDJPY, if you're the skeptic on ongoing rallies to have a restricted upside potential (as stated in our technical write up, the stiff resistance at 83.762 levels) and expects abrupt declines then the below strategy is advisable.

Ideally, this is an option trading strategy that is constructed by holding underlying spot FX while simultaneously buying a protective put and shorting calls against that holding.

Well, the strategy goes this way: while you're holding longs in spot FX of NZDJPY, go short in 2W (1.5%) OTM striking call and long in 2m (1%) OTM striking put. Since the short term, bullish sentiments are mounting we kept upside bracket little on a higher side.

This strategy is the best suitable if you're writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying security.

The NZD is projected to drop the most against the USD in 2017 and so does against JPY but moderately, NZDUSD reaching 0.64 by year-end. Downside medium-term kiwi volatility is expensive, suggesting RKO puts. Buy NZDUSD 1y put strike 0.68 RKO 0.59 for 0.98% (spot ref: 0.6997), which compares with 3.85% for the vanilla.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell