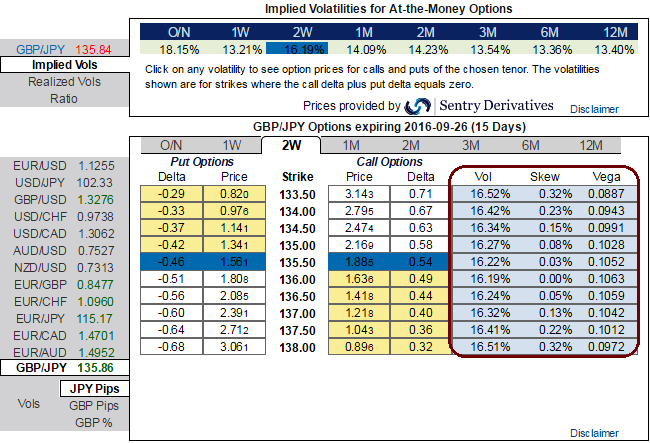

1W and 2W ATM IVs of GBP crosses are rising dramatically in OTC markets, GBPJPY flashing more than 13% and 16% respectively ahead of this week’s monetary policy by Bank of England which is likely to stand pat but previous minutes hint on more easing on the cards.

Please have a glance on how implied volatilities skews of ATM puts of 1w and 2W are positively correlated to the OTM strikes on both calls and puts.

Data front, BoE on Thursday will be the major focus, with the inflation report seeing expected effects from Brexit on the real economy. Markets awaits further stimulus in the days to come, to price about 80% chance for another 25bp cut in Bank rate in upcoming future and some looking for more QE. PMI of all services, manufacturing, and construction sectors have been improved this time according to the previous stimulus in BoE’s monetary policy.

In spot FX of GBPJPY, technically the pair has again drifted below EMAs and DMAs to the current 135.860 levels, what is weighing on the pound's slumps is that, the expectations on BoE monetary policy changes but the chances for lower interest rates in rest of the 2016 has grown up, above all lingering post Brexit formalities adding an extra pressure on sterling's depreciation.

Hence, we advocate the suitable option strategy to hedge the potential downside risks by using any small bounces through ITM shorts; this would have certainly ensured returns in the form of premiums.

With the above technical and fundamental reasoning, we reckon to arrest potential downside risks of this pair by hedging through Put Ratio back Spread and accordingly, hedging framework was also suggested earlier, for now, it is reckoned that the underlying currency GBPJPY to make a large move on the downside.

So, stay firm with longs on 2 lots of 1M At-The-Money vega puts that would function effectively in higher IV times, long instruments to generate positive cash flows as underlying spot keeps declining, simultaneously, short 1 lot of OTM put with 1-week expiry.

The Vega would be at its maximum when the option is at ATM and declines exponentially as the option moves ITM or OTM owing to every tiny shift in IVs that will make no difference on the likelihood of an option far out-of-the-money expiring ITM.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist