A full belly doesn't like to study, the same applies to the FX market. As a result, the trading in USDKRW has been very tepid as the traders in New York still seem to be digesting their Thanksgiving and in the mood of Black-Friday - just like all the FOMC members probably are. Many will also stay away from their trading desks today so that momentum in USD is likely to be in short supply.

Nevertheless, KRW strengthened considerably in the recent past (about 3.18% versus USD in last two weeks).

The rate hike expectation in South Korea has triggered the recent sell-off in USDKRW.

However, with an increased focus on repricing and reassessment of DM interest rates and monetary policy, G10 FX forecasts have had more revisions than EM FX forecasts in the past month.

The FX street seemed to be overweight in EM even as the recent rise in US yields has prompted a larger-than-usual response. Conditions for a larger, more sustained USD rebound remain unmet, the forecast revisions in the past month are idiosyncratic and mixed versus the dollar, but projections for broad directionality of the USD remain unchanged.

More noticeably, yesterday’s FOMC Minutes are almost universally interpreted as implying that a December rate hike is a ‘done deal’ but the longer-term outlook is ‘dovish’.

We could foresee bullish risks in the dollar on account of a) Inflation convincingly bounces back, further validating the dots; b) Feds’ hiking cycle most likely to continue c) Rest of world normalization is depriced.

Hence, at any cost, the pair may bounce back, especially, on the eve of Christmas. Subsequently, we emphasize buying Dec-22 USDKRW 1x1.5 call ratio spreads in this write-up, using strikes at 1090 /1110, indicative offer: 0.28% (vs 0.65% for the 1090 strike, spot ref: 1085).

Max leverage: 5 times of shorting the topside strike in 1.5 times the notional of the near leg provides a 55% discount on the 1090 call strike. A full reversal of the past two-month performance is required before there would be negative P&L.

Investors could also consider a 1x2 call ratio: the discount to 1090 call strike rises to around 70% and maximum leverage to 8.5x but the level at which the trade starts experiencing negative P&L is much lower (1128).

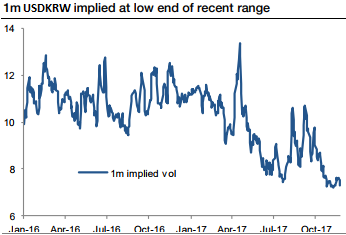

Low vol and moderately high skew Short-dated volatility parameters are conducive to position for a limited (2-4%) correction.

Vol: One-month implied volatility is at the lowest level since 2014 while the premium of implied over realized is at its two-year average (refer above chart).

Skew: Risk reversals have compressed alongside easing in North Korea tensions and the move lower in the spot, but selling topside is still the most advantageous versus regional peers.

The maximum loss is limited to the extent of the premium paid below 1090 and unlimited above 1144.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts