The Australian economy is starting to lose momentum and Q3 GDP partials are pointing to a weak print. This makes receiving the front end tempting at current levels, but the inexorable pull of higher yields globally suggests the bar to a significant rally in the front end looks high in the near-term.

On the international data front, PMI surveys across China, the euro area, and the US will provide a pulse on global activity through November. We do not expect to see a material acceleration or slowing in these data, and as such do not think that there will be much of an impact on the AUD.

In Australia, the data flow remains light, but Q3 capex data next week are worth watching to get an update on private sector investment intentions. We know from the business surveys that these will likely remain tepid - reinforcing the view that the RBA will likely remain on the sidelines.

OTC Updates and Hedging Framework:

It seems rational that antipodeans currency crosses as “high yielding” avenues that suffer more as a result of the USD strength than most other G10 currencies.

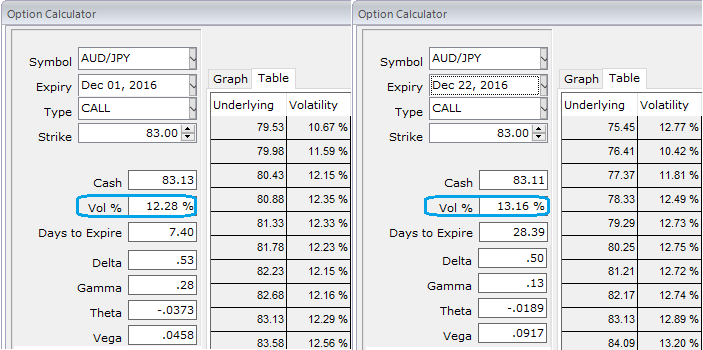

1w at the money volatilities of 50% delta calls and puts are at trading around 12.28% and 13.16% for 1m tenors which is reasonable as the vols currently are working in the interest of option holders in month tenor as you can see IVs and corresponding movements in vega.

Please also be noted that the 1w ATM call is trading exorbitantly at 17.33% above NPV, while 1m calls trading at just shy above 7.5% of NPV, hence, we reckon 1m derivative instruments are more beneficial than 1w tenors in comparison with IVs.

We think 1w AUDJPY IVs are blowing out of the proportion in OTC FX markets that pops up with rising IVs above 12.28% for 1-week expiries despite having less significance economic drivers that propel this currency pair to anywhere. However, 1m IVs to encompass the above stated data announcements.

Well, in order to arrest this upside risk, we recommend option strap strategy that favors underlying spot’s upside bias.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 1M ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of the same expiries.

As shown in the diagram, this AUDJPY option straps strategy should take care of both upswings and any abrupt downswings just in case RBA surprises the forecasters, and the strategy is likely to derive handsome returns on the upside and certain yields regardless of swings on either side but with more potential on the upside.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure