FC Barcelona is negotiating a new sponsorship deal with Nike while planning a €100 million loan to address financial challenges. The club seeks alternative funding after the anticipated investment from Libero fell through, highlighting ongoing fiscal uncertainties.

FC Barcelona Eyes €100M Loan Tied to Nike Deal to Bridge Financial Gaps and Address Debt Commitments

According to “La Vanguardia” (via Mundo Deportivo), FC Barcelona is negotiating a new loan of up to 100 million euros, contingent upon the outcome of the new agreement with Nike. This potential loan, if secured, could play a crucial role in bridging the financial gaps caused by the deficit and debt commitments, offering a glimmer of hope for the club's financial stability.

The research underscores the most significant risk to FC Barcelona's financial health, the valuation of 51% of Barça Media, which includes the esteemed Barça Studios. Suppose a new investor does not step forward by June 30. In that case, the club may be compelled to inject its funds or risk losing the projected income, presenting a pressing financial dilemma that requires immediate attention.

It is no secret that FC Barcelona is at its peak financial performance. Although the situation appears to be slightly better than in previous courses, it still seems to be a big ballast for the picture culé, not only to purchase "top" players, as explained by Xavi Hernández in the previous press conference regarding the commitment against the UD Almería but also to resolve other daily issues in the club's life.

According to FC Barcelona Noticias, due to the fiscally austere scenario that traverses the combined Barcelona, FC Barcelona appears to be in a position to negotiate the issuance of a fresh credit of approximately 100 million euros, according to "The Avant-garde." This is subject to the terms of the renegociación of the sponsorship with Nike, which will pay ten million euros less this year due to the Catalan cast's performance in European contests.

In this regard, it is crucial to note that if a renegociación agreement is reached with the "swoosh" company, a portion of the American company will implement a signing premium of 100 million euros. This would be extremely advantageous to the Barcelona cast because it would help cover the club's potential economic deficit as the season ends.

FC Barcelona Faces Potential Losses Despite €859M Budget

It is important to remember that in October, FC Barcelona authorized an 859-million-euro budget with net profits of 11 "kilos." Nonetheless, it has recently become possible that this activity will result in losses. Here, it roots the importance of purchasing this credit or having the premium of signing by part of the afamado American sponsor since they would serve to cover the needs of derivative liquidity of the year's deficit, which has also been generated because of the problems to receive the money of 49% of Barça Studios and the Renacimiento of debt that the Barcelona club has.

In addition to the credit or agreement with Nike, these 100 million euros are critical to avoiding losing the exercise and regaining the 1:1 rule in La Liga. This would allow the combined Catalan to try to reinforce adequately and offer him a quality boost to the staff.

In front of this, according to desveló 'The Avant-garde,' the significant threat for the combined City Condal is that in the past year, Joan Laporta aimed more than 400 M€ in the arks of the club, half as an assessment of 51% of the sale of Barça Half that still possesses, and the other 200 M€ as the profit of the sale of the remaining 49%. If the club culé does not find a new investor by June 30, it will be forced to make contributions or convert that unusual entry into losses, resulting in the “Fair Play” of the highly devoted team.

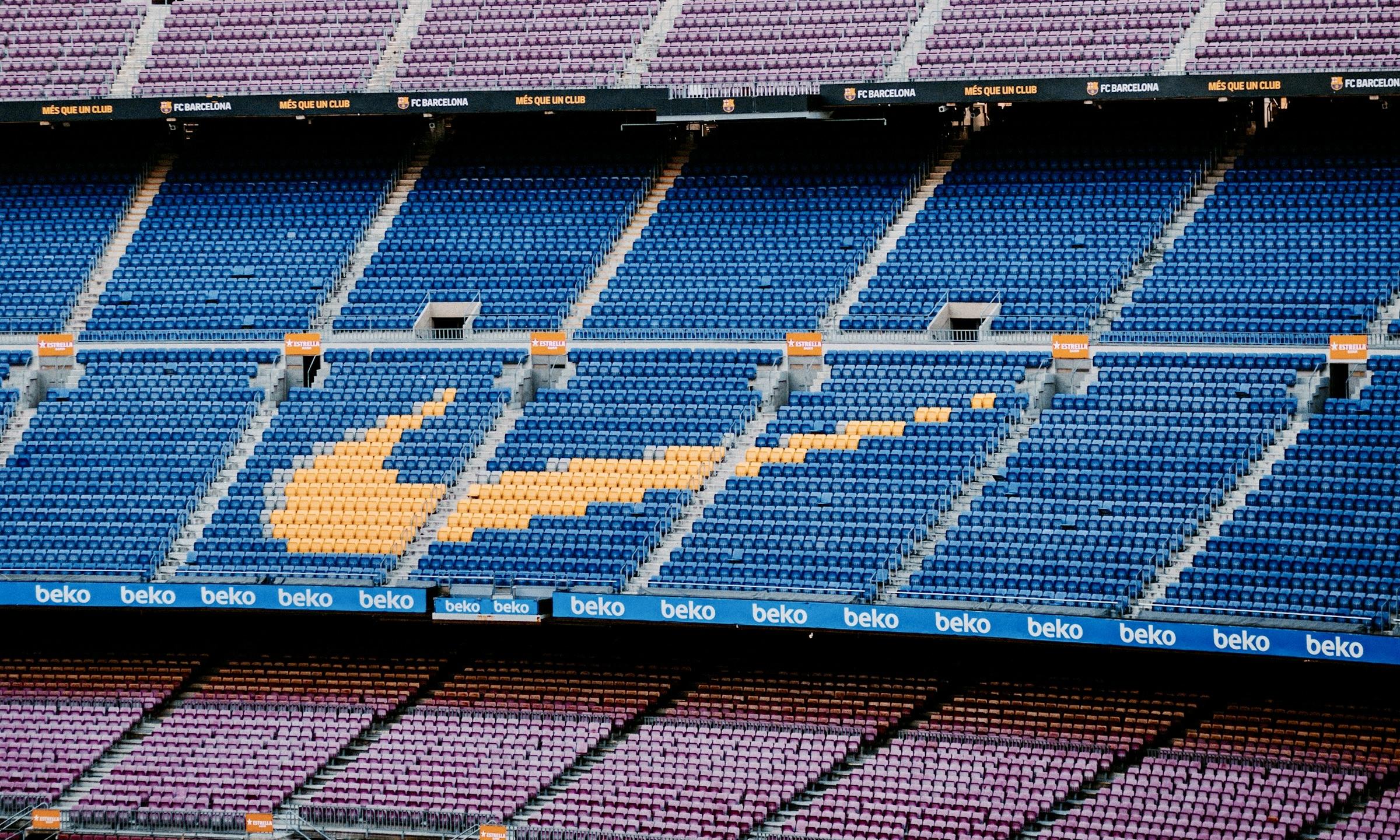

Photo: wu yi/Unsplash

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment