While Euro vol is more sensitive to the ebb and flow of Italy headlines, JPY is more levered to contagion from an escalation of trade tensions. Even absent these risks, there are good reasons for directional yen ownership – structural under-valuation, susceptibility to hawkish BoJ policy tweaks.

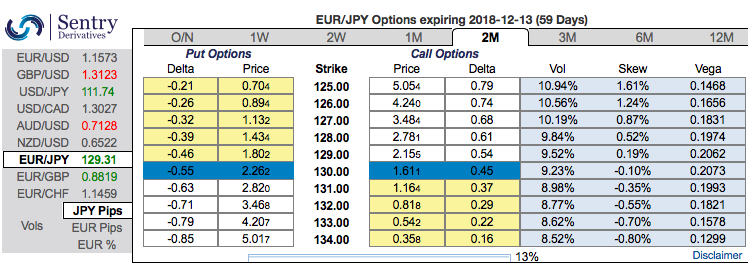

Hedging skewness: Please be noted that the positively skewed IVs of 2m tenors are signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 125 levels so that OTM instruments would expire in-the-money.

Risk reversals: Most importantly, to substantiate the above indications, negative risk reversal numbers of all euro crosses except EURGBP (especially EURJPY) across all tenors are also substantiating bearish risks in the long run amid minor abrupt upswings in the short-term. IVs for 2w tenors are on lower side which is interpreted as conducive for put option writers, and 2m IVs are on higher side which is good for the put holders.

Overall OTC barometer: OTC positions of noteworthy size in the forex options market can stimulate on the underlying forex spot rate. The Market Pin Risk report shows large options expiring in the next 5 days. Red strikes indicate sizeable open interest close to the current forex spot rate. FX Options strikes in large notional amounts, when close to the current spot level, can have a magnetic effect on spot prices (in this case, EURJPY has the highest interest towards forward point at 128.90). The spot may trend around those strikes as the holders of the options will aggressively hedge the underlying delta.

While the OTC volume index exhibits volume traded in the last 24-hours versus a rolling one month daily average, and euro options are buzzing on above-stated news flows (especially, EURJPY contracts to trade 2ndhighest volumes). Without capturing all OTC flow, the index is a barometer of volume on liquid contracts for different crosses. Values over 100 indicate volume higher than the average, values under 100 indicate volume lower than the average.

Options Trade Tips (EURJPY):

Buy 2m EURJPY ATM -0.49 delta puts for aggressive bears on hedging grounds. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1.

Buy 2M EUR puts/JPY calls vs. sell 2M 28D EUR puts/KRW calls for directional traders. Source: sentrix, saxobank

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 4 levels (which is neutral), while hourly JPY spot index was at 73 (bullish) while articulating at (10:37 GMT). For more details on the index, please refer below weblink:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields