This week, the flurry of economic data has surrounded USDCAD pair.

Canadian GDP on Wednesday, consensus 0.5% and previous -0.6%.

Canadian trade balance on Friday, consensus -3.2B and previous -3.6B. Canadian merchandise trade deficit came in at CAD 3.63 billion in June 2016 compared to a revised CAD 3.50 billion gap in the previous month, missing market consensus.

Continued lag in exports may force the Bank of Canada’s hand before results of Trudeau’s stimulus might begin to show. But for the July month, the consensus stays to have contracted trade deficit flashes.

On US side, consumer confidence on Tuesday and non-farm employment change on Wednesday, followed by unemployment claims on Thursday and trade balance on Friday are scheduled.

Technically, USDCAD clears 1.2950 resistances with the break to two-week high, while leading oscillators indicate bullish momentum.

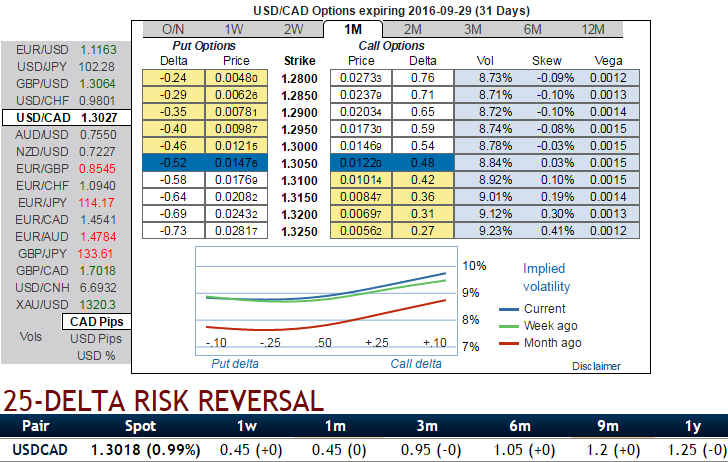

Please be noted that the 1m IV is gradually rising and positive IV skews on OTM call strikes, while positive risk reversals signify the hedging sentiment is lingering in OTC for upside risks of this pair.

If IV is high, it means the market thinks the price has the potential for large movement in either direction. Low IV implies the market thinks the price will not move much and so that it is beneficial for option writers.

Hence, we recommend initiating more long call positions so as to hedge upside risks in this pair, call ratio back spread may probably attain the ideal hedging objective by reducing the hedging cost as well.

1M ATM +0.51 delta call, 1 lot of (1%) OTM +0.36 delta call and simultaneously short 1 lot of deep OTM call (2%) with comparatively shorter expiry in the ratio of 2:1.

The lower strike short calls seems little risky but because IV is reducing, the likelihood of options expiring in the money is very less and it finances the purchase of the greater number of long calls (ATM calls are overpriced, so we chose 1% OTM calls as well) and the position is entered for reduced cost.

Delta measures the shift in option's premium with a corresponding shift in the currency pair exchange rate. Another way to think of Delta is as if it's your outright spot exposure.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed