Bullish USDCAD scenarios above 1.31 driven by:

1) NAFTA renegotiations break down and breakup fears return.

2) US growth expectations upgraded on policy driving broadly luring FOMC’s rising hikes which in turn lead to a broad US$ rebound.

The combination of trade tensions and still-neutral global growth momentum keeps us light on overall dollar exposure in the portfolio with a defensive tilt.

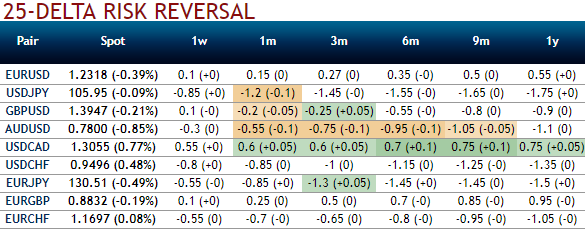

Please be noted that from spot rates of this pair has constantly been spiking, which is in line with the implied volatility skews, while indicating further upside risks are signaled by this positive skewness for OTM call strikes for 1m tenors. While risk reversals of this pair have also been indicating upside risks across all longer tenors (from 1m-1m).

Commodity FX vs USD is vulnerable to declines in the lead up to a potential dot plot shift at the March FOMC, especially given marginal dovish undertones to RBA, BOC, ECB and BoJ rhetoric this week.

That is the reason why the positively skewed IVs of 1m tenors signify the hedgers’ tendency for bullish risks as they bid for OTM call strikes and IVs of 1w and 1m tenors are at around 9.9% and 7.5%.

At spot ref: 1.3075 (while articulating) we advocate below FX derivatives strategy as we favor optionality to the directional trades. For the bullish streaks that we are inclined while not disregarding to position a partial retracement of the down move in near terms through call ratio back spreads (CRBS) with narrowed expiries, as calling the bottom is difficult and adding directional spot exposure is risky at the moment.

Using any abrupt dips, writing any overpriced ATM calls as shown in the diagram (the instrument is trading 14% more than NPV, whereas IV is just 9.9%, hence there has been the disparity) is a wise idea to reduce hedging costs of long delta calls. Thus, you decide to initiate a diagonal call ratio back spread (CRBS) at net debit.

Execute strategy this way, to arrest both short-term dips and long-term bullish risks, initiate shorts in 1W at the money call with positive theta, simultaneously, buy 2 lots of 1M (1%) out of the money 0.37 delta call option. Establish this option strategy if you expect that EURCAD would expect vigorous spikes during next 1 month’s tenor amid minor hic-ups in short run but spikes certainly not beyond your upper strikes.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying shy above -107 levels (highly bearish), while hourly USD spot index was at 52 (bullish) while articulating (at 11:05 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?