The UK growth data has shown a monthly rise of 0.3% in July GDP whereas the projections were at 0.2%. We reckon that the economy is on course to expand by 0.4% QoQ in Q3 as a whole.

Markets will continue to focus on Brexit developments. The pound was boosted last week by indications that a deal to avert a ‘cliff edge’ scenario next March may be nearer (even if difficult decisions are postponed until after Brexit).

The Bank of England (Thu) expected to keep interest rates firmly on hold at 0.75%.

The UK cabinet (Thu) is reportedly meeting to discuss the implications of ‘no deal’. The House of Lords (Tue), meanwhile, will discuss the trade bill passed by the Commons before the summer recess. Bank of England Governor Mark Carney is scheduled to speak in Dublin (Fri).

In the UK, Macroeconomic fundamentals, political factors continue to dominate the headlines, with further signs that the UK and the EU are entering the Brexit negotiations some distance apart.

Sterling immediately spiked higher following the last interest rate hike by Bank of England but slipped so soon back below its pre-announcement levels. It seems markets were unconvinced by the BoE’s relatively hawkish policy guidance, with Brexit uncertainties in particular, likely to have weighed on the currency.

On the flip side, Australia got a softer start to Q1 GDP accounting, Australia’s trade balance surged to A$1.87 billion on MoM, though the terms of trade release confirmed it was mainly a price, rather than volume story.

On all these macros standpoints could propel GBPAUD either on upswings or downswings but those who are with slightly biased upwards can consider below options strategy.

Hedging Framework:

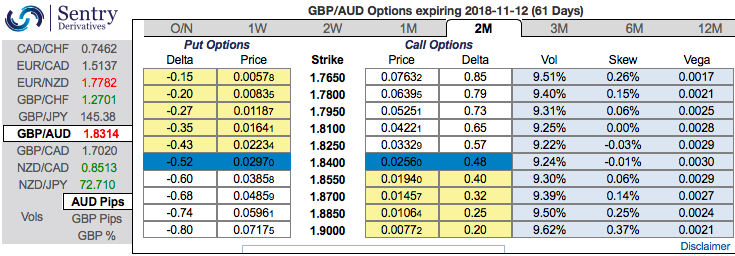

3-Way Options straddle versus put

Spread ratio: (Long 1: Long 1: Short 1)

The execution: Initiate long in GBPAUD 2M at the money delta put, long 2M at the money delta call and simultaneously, Short theta in 1m (1.5%) out of the money put option.

Rationale: Contemplating 2m IV skews that are well balanced on either side but with some upside traction (positively skews on towards OTM calls), we reckon that the Delta instruments are conducive to monitor directional risk so as to be aware that how much of option’s value would increase or diminish as the underlying market moves as this option tool measures the value of an option as the underlying spot FX moves. Well, ahigher (absolute) Delta value is desirable on long leg in the above stated strategy. Whereas, the Theta is positive on short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry).

The GBPAUD has currently been trading in non-directionally but with some bullish sentiments. Hence, we advocate the above hedging strategy with cost effectiveness that could hedge regardless of the swings on either side.

FxWirePro’s Currency Strength Index: Hourly AUD spot index is flashing 11(which is neutral), while hourly GBP spot index was at shy above 132 (bullish) at 08:40 GMT. For more details on the index, please refer below weblink:

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand