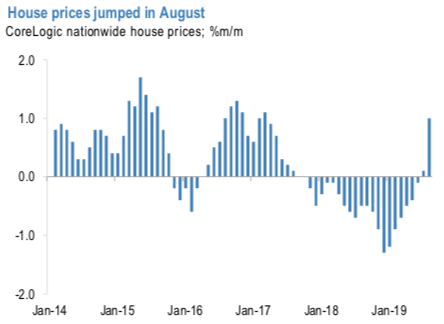

RBA’s monetary policy is scheduled for this week, Aussie central bank has signalled a desire to watch incoming dataflow, after easing 50bp earlier this year. Recent communication from the Bank has added a conditionality to further easing, and noted that an “accumulation of evidence” will be required before the Bank considers the need for further rate cuts. We view this as consistent with our view that the RBA is on hold for the remainder of the year, and recent housing numbers (loan growth and house prices – refer 1stchart) and labour market data lend support to this view.

Domestic monetary policy outcomes are likely to disappoint market pricing near term, but Australia won’t be alone in this dynamic meaning that implications for AUD are limited. The market has priced another 25bp of easing by year end – refer 2nd chart), and we are not convinced the RBA will deliver on this. However, other markets are likely to be subject to similar outcomes; this month has been notable so far for less dovish / more hawkish outcomes from central banks (for example, the BoC and Riksbank), and so AUD is unlikely to be the sole G10 victim of central bank disappointment in the next few months.

Ahead of the above event, we have listed both AUD’s bearish, bullish scenarios and strategize accordingly.

Bearish AUDUSD scenarios below 0.65 if:

1) the RBA cuts rates more quickly than we expect;

2) Fed rate cuts are no longer sufficient to prevent the US from entering recession;

3) the trade conflict between the US and China broadens;

4) the global economy slows more than expected, risking recession into year end.

Bullish AUDUSD scenarios above 0.70 if:

1) China eases policy more forcefully and commodities rally on the back of future infrastructure spend;

2) the Australian government commits to large fiscal easing, shoring up growth prospects and reducing the need for a further 50bp of easing from the RBA.

OTC Outlook and Options Recommendation:

Contemplating above factors, we will now quickly run you through OTC outlook of AUDUSD, before proceeding further into the options strategic framework.

Please be noted that the positively skewed IVs of 3m tenors still signify the hedgers’ interests to bid OTM put strikes up to 0.65 levels which is still in line with the above bearish projections (refer 1st nutshell).

Please also be noted that bearish risk reversals (RRs) across all the longer tenors are also in sync with the bearish scenarios (refer 2nd (RR) nutshell).

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the downside risks has been clear.

Accordingly, diagonal put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The execution of options strategy: Short 2w (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options.

The rationale: Bidding above 3m IV skews, we have advocated delta long puts for the long term on hedging grounds, comprising of more number of ITM long instruments and theta shorts with narrowed tenors for 1m lower IVs to optimize the strategy.

Bearish outlook with rising volatility good for the option holder.

While put writers would be on upper hand on theta shorts in OTM put options that would go worthless on lower IVs as the underlying spot FX keeps rising,. Thereby, the premiums received from this leg would be sure profit.

We keep reiterating that the deep in the money put option with a very strong delta will move in tandem with the underlying. Courtesy: Sentrix, JPM and Saxobank

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices