RBA has maintained the status quo in its monetary policy, keeping cash rates at 1.50%. Consequently, Aussie has shown vigorous rallies up to 0.7264 levels but the major downtrend seems to be intact.

While Australia's trade surplus expanded considerably to AUD 3.68 billion in December 2018 from an upwardly revised of AUD 2.26 billion, easily beating the market consensus of a surplus of AUD 2.3 billion. It was the largest trade surplus since December 2016, as exports fell by 2 percent to AUD 37.92 billion, while imports declined at a faster 6 percent to AUD 34.24 billion. Considering 2018 the whole year, the trade surplus surged to AUD 22.15 billion from AUD 9.87 billion in the same period of 2017.

Aussie imports of consumption goods fell 7.1% m/m as automobiles fell 25.3%, after increasing 12% in November. Capital goods were down 15.4% m/m, as the lumpy civil aircraft component fell 61%. Fuel imports declined 7.8%. Service imports rose 2.7% due to a 5.6% rise in travel.

AUDUSD OTCHedging Perspectives:

Let’s just quickly glance through OTC outlook of AUDUSD, before proceeding further into the strategic framework.

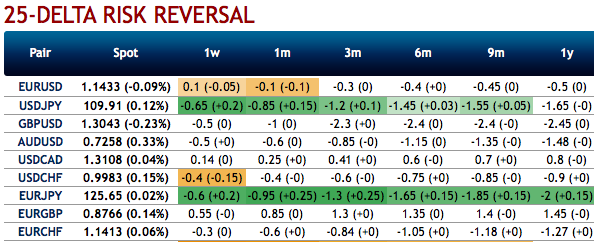

Please be noted that the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 0.70 level (which is in line with the risk reversal numbers (refer above nutshells).

The bearish neutral risk reversals of the 3-6m tenors that signifies the bearish scenarios, in that nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the downside risk projections. Courtesy: Sentrix, ANZ & Saxo bank

Currency Strength Index: FxWirePro's hourly AUD spot index has shown 55 (bullish), while USD is at 78 (bullish) while articulating at 10:16 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential