Bearish GBPJPY Scenarios:

1) A no-deal Brexit (GBP down between 10-20%).

2) PM May is replaced by a hard-liner-Brexiteer, potentially following poor results in the European election. This could pave the way to #1if the government was able to secure a larger majority in an early election.

3) The global investors’ risk aversion heightens significantly,

4) The US starts vehemently criticizing Japan’s trade surplus against the US and

5) Japan's economy further decelerates and speculations for the BoJ’s additional easing grows.

Bullish GBPJPY Scenarios:

1) A second referendum (GBP +3-4%).

2) Brexit is canceled, either unilaterally by parliament or following a second referendum (GBP +7-8%).

3) The acceleration in US inflation leads to aggressive Fed hikes and a spike in UST yields and

4) The momentum in JPY selling flows related to outward portfolio investments and FDI strengthens.

Major risk events:

European elections May 23rd.

New Article 50 deadline, October 31st.

BoJ meeting is scheduled on June 20th.

US-Japan trade talk (end-May)

Global risk factors (US-China trade war escalation, US debt ceiling discussions) to materialize.

GBPJPY has had a roller coaster ride on Brexit drama. Sterling recovered considerably as Theresa May offered new Brexit plan on Tuesday but MPs reacted negatively to UK PM’s last effort. Today May will present her new Brexit deal which will contain a 10 point plan which is intended to make plan attractive to MP. The chance of winning withdrawal agreement vote in the house of commons for UK PM is very negligible which is going to happen on Jun 3rd. The pair hits high of 141.72 yesterday and started to decline sharply. It is currently trading around 139.86 levels.

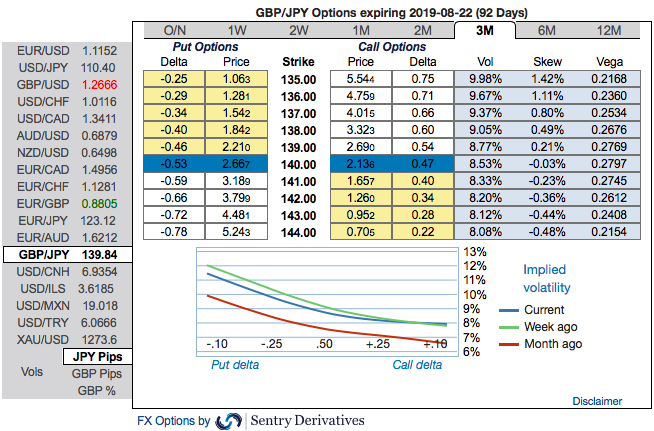

OTC outlook and Hedging Strategy: Amid huge turbulence, please be noted that IVs of this pair that display the highest number among entire G7 FX universe.

While the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 135 levels (refer above nutshell evidencing IV skews).

Accordingly, put ratio back spreads (PRBS)are advocated on the hedging grounds. Both the speculators and hedgers who are interested in bearish risks are advised to capitalize on current abrupt and momentary price rallies and bidding theta shorts in short run, on the flip side, 3m skews to optimally utilize delta longs.

The execution: Capitalizing on any minor upswings , we advocate shorting 2m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, go long in 2 lots of delta long in 2m ATM -0.49 delta put options (spot reference: 139.86 levels).

The rationale for PRBS: Well, the traders tend to perceive these trades as a bear strategy, because it deploys more puts. But actually, it is a volatility strategy.

Hence, entering the position when implied volatility is high and anticipating for the inevitable adjustment is a wise thing, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a “price neutral” approach to options and one that makes a lot of sense.

The position is a spread with limited loss potential, but varying profit potential. The degree of profit relies on the strength and rapidity of price movement. The position uses long and short puts in a ratio, such as 2:1 or 3:2, to maximize returns.

Every underlying move towards the ITM territory increases the Vega, Gamma, and Delta which boosts premium. As you could observe spot GBPJPY keeps dipping, these delta longs would become in the money, while these derivatives instruments target further bearishness of this pair. Courtesy: Sentrix & JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -142 (which is highly bearish), while hourly JPY spot index was at -122 (highly bearish) while articulating (at 10:36 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation