Bearish GBPUSD Scenarios:

1) A no-deal Brexit (GBP down between 10% and 20%).

2) The Tories continues a material opinion poll bounce under Johnson, increasing the odds on an early election and the removal of parliament’s blocking majority on a no-deal.

3) UK recession.

Bullish GBPUSD Scenarios:

1) Tories drop in the polls, Johnson loses a no-confidence vote and the subsequent general election (cable 1.30).

2) Article 50 is eventually withdrawn.

GBPUSD has approached its 3-month downtrend line at 1.2022 level, and we look for this to hold the initial test but that appears to be momentary. Only a close above the downtrend this would introduce scope towards 1.2416 (which is 55-day ma). Otherwise, major downtrend still remains intact.

Let’s now quickly glance at OTC outlook and suitable strategy for GBPUSD swings.

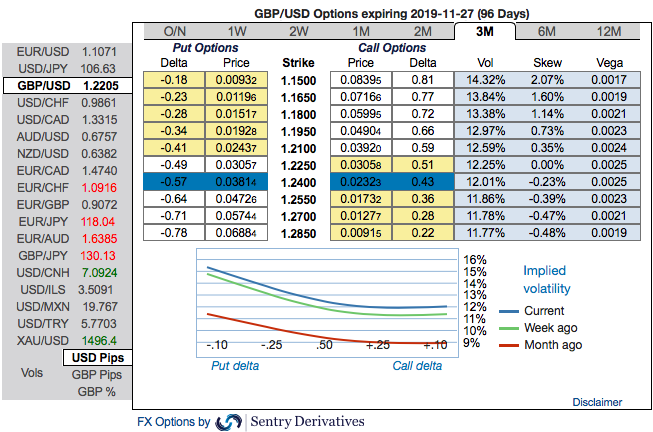

OTC outlook: The positively skewed implied volatilities of 3m tenors have still stretched towards OTM put strikes that indicates the hedging sentiments for the downside risks. To substantiate the downside risk sentiment, risk reversals have also been signaling bearish hedging sentiments. Some positive shift is observed in the bearish risk reversal numbers in the shorter tenors.

From the GBP OTC outlook, amid major downtrend we reckon that the sterling should not suffer like before, but, one should not disregard the Brexit settlement risks on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favourable result of the Brexit process.

Stay short sterling via a limited loss tail hedge: Stay short a 2M GBPUSD 30d/10d bear put spread on August 2nd(spot reference: 1.22 level). Paid 0.66%. Marked at +0.74%. Courtesy: Sentrix, Saxo & JPM

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch