The Eurozone inflation rate was revised slightly lower to 0.3 percent in April 2020, from a preliminary estimate of 0.4 percent. It was the lowest rate since August 2016, as energy prices fell 9.7 percent, more than initially thought, amid the coronavirus pandemic and an oil price war between Russia and Saudi Arabia.

Eurozone consumer confidence is expected to have fallen for the third successive month. We look for May’s reading to have slipped to -26 from -22.7 in April. Eurozone PMI data is also scheduled to be announced this week.

Like many currencies EUR has been sidewinding vs USD over the past two months. The decline in EUR's negative carry vs USD is likely to be playing a certain role in this stability, as the decline in effective USD interest rates (the normalization of the FRA/OIS spread and the x-ccy basis) is bound to slow, and potentially even to reverse, some of the short-term capital outflows that had contributed to the decline in EURUSD throughout the era of high US rates.

Bearish EURUSD Scenarios:

1) A second Covid-19 wave that does further damage to public finances.

2) Continued failure of Euro area governments to agree joint fiscal issuance or material fiscal transfers to fund economic rebuilding.

3) Italy loses investment grade status.

4) UK leaves the EU at year-end with no trade deal.

5) GCC blocks Bundesbank participation in QE.

Bullish EURUSD Scenarios:

1) Political progress towards debt mutualisation and/or more significant fiscal transfers as part of the recovery plan.

2) All countries tap the ESM facility and the ECB stands ready to activate the OMT facility.

3) ECB aggressively expands PEPP in support of peripheral markets.

4) The UK extends its transition period for Brexit beyond end-2020.

It would be presumptuous to turn this into an argument for why the EURUSD exchange rate should breach the 1.0750/1.1000 range. In particular as the lack of monetary policy scope on either side of the Atlantic makes spectacular swings to the exchange rate unlikely anyway. However, it is interpreted that the fact that EURUSD is once again trading at the upper end of this range not just as the effect of risk-on sentiment but as a reflection of the fact that the US currency is no longer that far superior to the European when it comes to safe haven qualities.

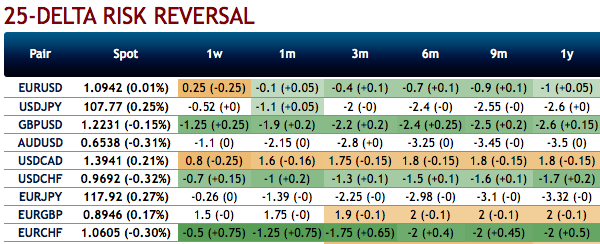

Options Strategy And Rationale: EUR risk-reversal numbers have indicated the mounting hedging sentiments for the bearish risks amid mild fresh positive bids are observed (1st chart).

Most importantly, the positively skewed EURUSD IVs of 6m tenors are indicating downside hedging risks (refer 2nd chart).

Hence, considering these OTC bids, the below options strategies are advocated, we now wish to uphold the same strategies.

Bidding 6m skews, initiated long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, simultaneously write an (1%) out of the money put option of 2w tenors, (spot reference: 1.0960 levels). Any slumps from here onwards are to be arrested by the 2 lots of ATM long-legs. Those who are sceptic about mild rallies, 3m 1% in the money puts with attractive delta are also advised on a hedging ground. The in-the-money put option with a very strong delta will move in tandem with the underlying. EURUSD is currently rising higher, those who want to participate in the prevailing rallies that seems momentary, one can freshly initiate the strategy capitalizing these momentary rallies. Courtesy: Sentry, JPM & Saxo

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge