GBP has been a notable outperformer since the last KCV, albeit correcting lower in recent days as a May rate hike is called into question. Intra-month cable and the GBP NEER established fresh post-referendum highs, cable jumping three cents to 1.43 and the GBP NEER gaining 2.5% to halve the Brexit losses from a maximum of 16%. There is no single factor which explains this outperformance.

Instead, it reflected a combination of a fading of Brexit risks following the agreement in principle on a stand-still, two-year Brexit transition, confidence in the BoE’s tightening cycle, a mooted large M&A deal in the pharma sector, and unusually strong albeit opaque seasonal factors which likely encouraged traders to increase tactical GBP positions. Indeed, speculative longs rose to virtually their highest level since before the financial crisis, a stark contrast with record shorts last year.

Despite the bullish price action, we remain circumspect about GBP’s prospects in view of a less than convincing macro backdrop characterized by underperformance in growth and outperformance in inflation (the forecasts are unchanged and envisage a broad consolidation in the GBP TWI over the coming year).

In the last few months, the FX market has been indifferent to weak growth, drawing comfort instead from the BoE’s resolute attitude towards policy normalization to address inflation. But in our view, the composition of nominal GDP growth does matter for GBP, not least because of the potential feedback loop from FX appreciation to inflation that could neutralize the pretext for extended tightening and so short-circuit the recovery in GBP absent faster growth.

OTC update and hedging grounds:

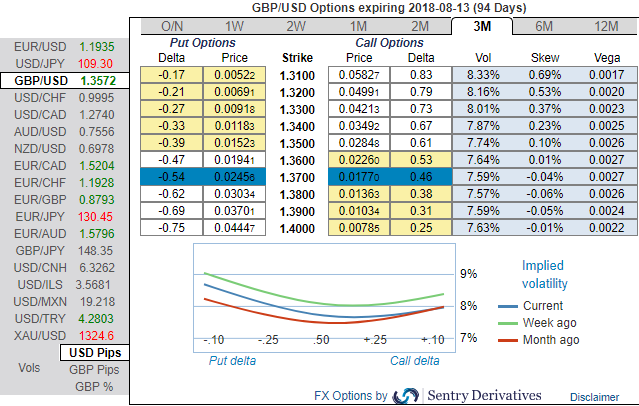

Let’s glance on GBPUSD sensitivity tool, the positively skewed IVs of 3m tenors are signaling the hedging interests in the bearish risks, 3m bids are upto 1.31 levels. As a result, OTM puts strikes likely to expiring in-the-money.

While there no shift in risks reversals (refer 1m RRs – bearish neutral) that indicates the bearish risks remain intact in the underlying spot FX prices in near-terms which is in tandem with the technical analysis but bearish sentiments are mounting in medium term basis (3m tenors).

In order to arrest downside risk that is lingering in the major declining trend, we recommend options strips strategy that favors underlying spot’s downside bias in the short-run and mitigates bearish risks.

Hence, we advocate building the FX portfolio exposed to this pair with longs positions in 2 lots of 3M ATM 0.51 delta puts and 1 lot of ATM -0.49 delta calls of 3m expiries, these options positions construct smart hedging at net debit.

The strategy is likely to mitigate both bearish as well as bullish risks irrespective of spot moves. However, on both hedging and speculative grounds as more potential is foreseen on the downside.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure