GBP vols bounced this week after PM May called a snap general election. 1M ATMs are up 0.5 pts. on the week, while 2M expiries that cover the June 8th election date are 0.7 pts. higher to account for the increased event weight.

We have no quarrel with this re-pricing: an information shock that delivers a 2.5% intra-day range in the spot with risks of follow-through in coming days via forced liquidation of one-way short spec positions (basis IMMs) can and should push up gamma vols.

The election event itself is not particularly binary given the extent of the Conservative polling lead, hence day-weight should be significantly smaller than for the Brexit referendum or the French elections.

Nonetheless, GBP gamma is a worthy buy, especially in the likes of GBPCAD, GBPAUD and GBPNZD that all look cheap on our screens, purely because of the likely whipsaw in the pound going forward as the market turns its attention to assessing the full implications of the change in British political landscape once the French vote is out of the way.

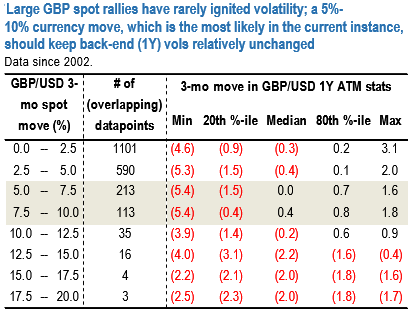

GBP gamma can perform near term as deep underweight spec positions are liquidated; GBPAUD, GBPCAD and GBPNZD screen cheap. Longer-dated (6M-1Y) GBP vol should remain contained, however; we are biased to sell 9M-1Y GBP vega on rallies.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data