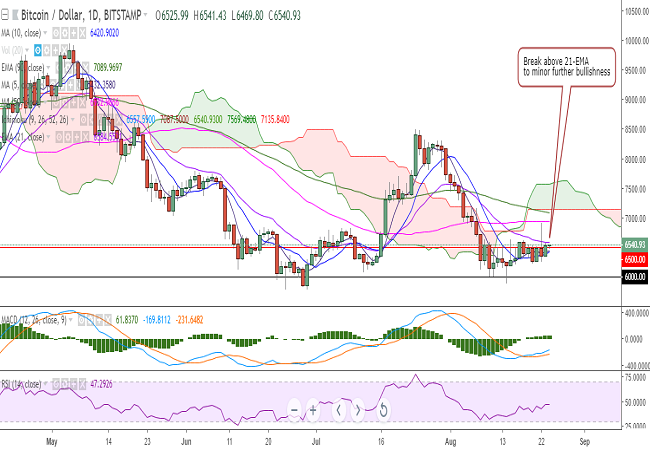

(Refer BTC/USD chart on Trading View)

BTC/USD closed above 20-DMA at 6525 levels on Thursday and is trying to hold its strength above the 6500 mark.

The pair is currently trading at 6518 levels at the time of writing (Bitstamp).

On the top side, resistance is now seen at 6582 (21-EMA) and a break above would test 6725 (3h 200-SMA)/ 6879 (38.2% retracement of 8496.96 and 5880)/6930 (50-DMA)/7000.

On the downside, a decisive break below 6418 (10-DMA) would see the pair testing 6272 (61.8% retracement of 5880 and 6906.81)/6200. Further weakness would drag it to 6120 (June 13 low)/6000/5920 (February 6 low).

Overall bias remains neutral with the pair’s upside capped by 21-EMA. A consistent break above could see some bullishness in the pair.

Recommendation: Wait for clear directional bias.

FxWirePro: BTC/USD tries to hold above 6500, break above 21-EMA to see minor bullishness

Friday, August 24, 2018 7:36 AM UTC

Editor's Picks

- Market Data

Most Popular

2

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary