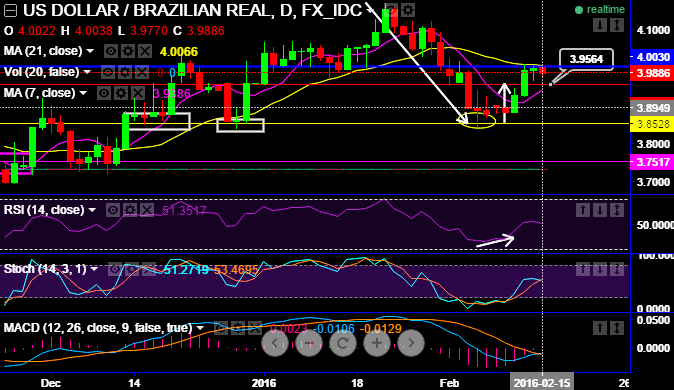

Technically, USDBRL has been losing upswings momentum as the rejection of resistance at 4.0050 levels and as soon as the pair approached 21DMA the bears began pushing downwards, in between a hanging man pattern is formed on rallies to signal weakness in previous upswings, leading oscillators are also converging these price declines. The next strong support is only seen at 3.9550 levels.

Nevertheless, this week markets are back to full-time activity as the carnival festivities are over. The main domestic price drivers in the weeks to come are likely to be the usual suspects: lack of political cohesion and concerns about the fiscal consolidation.

The government postponed the budget announcement to March, heightening concerns about its commitment to the current budget target (primary surplus of 0.5% of GDP). Furthermore, there are discussions on introducing a range for the primary surplus target.

In terms of data, the highlight of the week is December retail sales. We forecast a 2.0% decline in the retail sales index, partially paying back the increase in November due to the Black Friday sales.

For the broader index, the fall of 6.3% m/m sa in auto sales should contract the retail sales index by 2.7% m/m during the month, representing a 8.7% decrease for the whole year.

Concerns about the fiscal consolidation, and the likely resumption of political infighting will keep weighing on local assets.

Central banks that uphold pegs have been under strain after tumbling commodity prices and slowing global growth weakened currencies from Brazil to Russia by at least 18 percent in the past year.

We maintain our long USDBRL recommendation and keep long exposure to real rates as Brazil enters a regime of fiscal dominance.

FxWirePro: BRL short term gains likely but Brazilian political deferment and retail sales to pressurize downside risks

Monday, February 15, 2016 1:07 PM UTC

Editor's Picks

- Market Data

Most Popular

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms

U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links