The Sterling appreciated notably in the recent times. Anyone looking for a convincing reason behind this move would probably be dissatisfied.

We individually reckon that it is unconvincing and unsustainable as the reason behind it that is being cited was Prime Minister Theresa May’s assertion to British commerce that Great Britain would not leave the EU without a trade agreement or a transitional solution. In particular, as she made these comments hours before the move in the GBP exchange rates.

Moreover a “hard Brexit” is still not off the agenda in my view. Of course, it is in the interest of Great Britain not to leave the EU without some kind of agreement, the only difficulty will be convincing the EU-27 of this.

In this context, May still does not explain how she intends to secure access to the single market without having to accept the freedom of movement. The potential for a reversal in Sterling thus remains high.

On the flip side, Crude oil prices were up by almost 2% on Monday (we’ve seen a sharp gap up opening today) on renewed optimism that OPEC would agree to cut output.

OPEC members are currently negotiating to deliver a planned cut in output to 32.5-33 million barrels a day, so, we could more prospects for crude prices which in turn could act as a positive driving force for oil driven currencies like CAD.

Hedging Strategy:

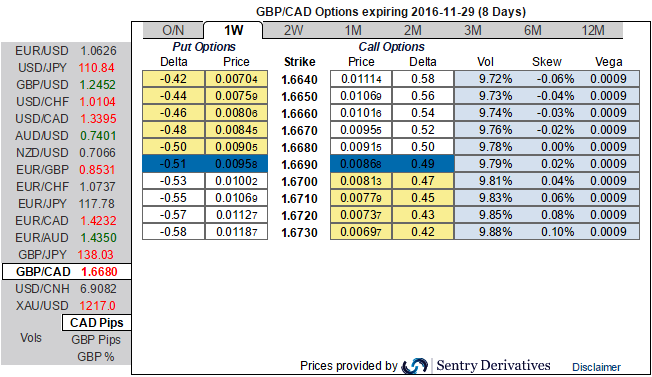

As we could see an equal potential for both currencies but slightly biased with CAD, in order to keep underlying FX price on the check, we recommend deploying 3-way straddles using At-The-Money calls and puts in this dubious situation.

We foresee crude’s uptrend but because of bullish sensation backed by the speculation from oil minors in supply glut, we also foresee as a result of the above-stated news, the trend of this pair seems to be uncertain for now which is evident on monthly charts but bearish biased.

While the implied volatility of 1w GBPCAD ATM contracts are just shy above 10.30%.

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Since underlying spot FX is non-directional but bearish bias, 1w IV skews also do not pop up any dramatic figures that could boost option prices in the days to come.

The Execution:

Go long in GBPCAD 1w at the money delta put, Go long 1w at the money delta call and simultaneously, Short 2W (1%) out of the money calls with positive theta or closer zero.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed