Aussie dollar gained Tuesday on better than expected housing and private sector credit figures and the yen retraced earlier gains on household spending, industrial output and unemployment aided sentiment.

While, their current account deficit has been reduced from previous -22.6B to the current -20.8B versus forecasts at -19.3B. This improvement in CAD is major driven by exports.

The volume of exports rose 4.4% in Q1, underpinned by strong export volumes for resources (+5.6% q/q) and services (+6.1% q/q). Resource exports across the board saw strong volume increases with the exception of metals. Manufacturing exports volumes also rose while rural export volumes fell.

After the release of key partial indicators, we still expect Q1 GDP to have risen a solid 0.8% q/q and 2.9% y/y.

Wages, net exports, and public spending came out in line with our forecasts.

Once again, the volatility in GDP growth looks to have been driven by net exports. Based on today’s Balance of Payments release, it has swung from a contribution of zero in Q4 to 1.1ppt in Q1.

The volatility in the quarterly data makes it more difficult to read the underlying momentum in the economy, but annual growth of 2.9% tells a story of ongoing moderate growth.

Well, overall, the trade dropped 1.9% in Q1 to be 11.5% lower YoY.

The net income deficit widened a touch to AUD12.1bn (2.9% of GDP) from AUD11.1bn in Q4 2015.

We could foresee AUD/USD getting stuck in its 0.6936/0.7838 range, mirroring the lack of direction in front-end AU-US rate spreads.

We think the spread could narrow from both sides over the next 3m, pushing AUD/USD lower.

We also anticipate calls for two more cuts from the RBA in H1 2016 though there is a higher risk now that those cuts are delayed, whereas the speculations on Fed's rate hike on the other hand is also mounting in June.

We think the spread could narrow from both sides over the next 3m, pushing AUD/USD lower.

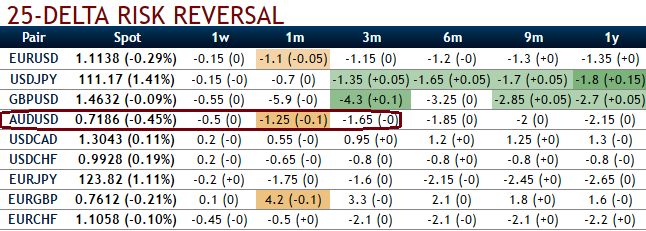

Hence, bidding on 1m-3m risk reversals one can buy ATM put options for hedging long term downside risks of AUDUSD.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis