The RBA’s Q3 print sat awkwardly for the market, with the first blush of headline inflation leaving investors pondering if the low has been set. However, underlying inflation was certainly soft and does not eliminate the possibility of a rate cut in 2017 if other sectors of the economy slow down.

Rates markets reacted to the CPI print by reducing the OIS pricing for policy easing over the next year despite the weakness in the core reading. There’s a risk the rates market could reverse some of this, so tactical longs or selling BEIs might play out well. The month-end index extension will also be the largest on record and could help flatten the bond curve. Note that the Australian core rates market has AUD5.9bn of maturities in November.

The AUD is trading in ever tighter ranges. Higher commodity prices are providing fundamental support but topside resistance is proving fierce. To break sustainably higher we think a wholesale shift in the market’s view of the RBA would be needed. This seems unlikely in the near term, however, with Q3 CPI highlighting that inflationary pressures remain weak.

OTC updates and Hedging Strategy:

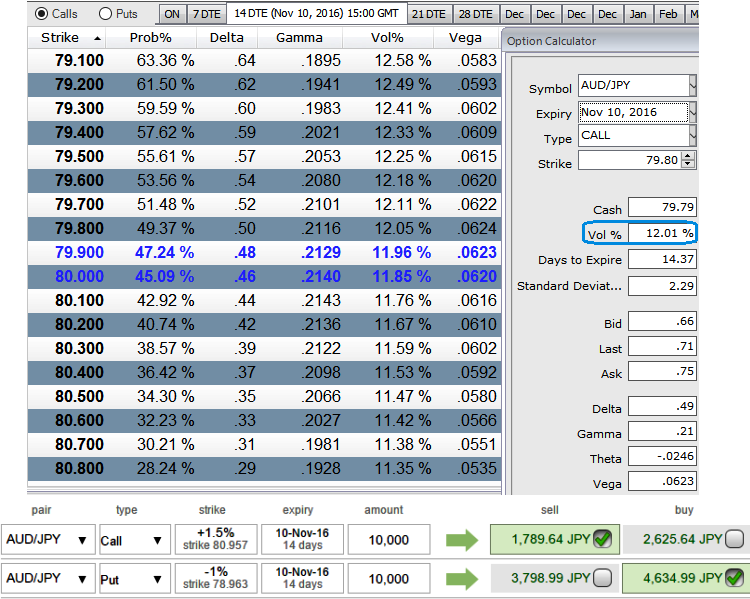

As the Aussie dollar gains have been edgy to extend due to RBA hints on status quo (RBA’s monetary policy meeting is scheduled on Monday), cover spot risks in AUDJPY through collar spreads.

2w ATM IVs are spiking higher above 12% and the short-term trend seems slightly weaker.

As a result, if you're the skeptic on ongoing rallies to have a restricted upside potential and expects abrupt declines then the below strategy is advisable.

Ideally, this is an option trading strategy that is constructed by holding underlying spot FX while simultaneously buying the protective put and shorting calls against that holding.

Thus, the strategy goes this way: while you're holding longs in spot FX of AUDJPY, go short in 2w (1.5%) OTM striking call and long in 2w (1%) OTM striking put. Since the short term bullish sentiments are mounting we kept upside bracket little on the higher side.

This strategy is the best suitable if you're writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying security.

This serves as an economical strategy to deploy if you are writing covered calls to earn premiums but wish to protect yourself from an unexpected sharp drop in the price of the underlying spot.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom