Brexit caused two Sterling debacles, first in June with the vote and then after the summer when PM May suggested a hard exit. In spite of GBPJPY downtrend, election clears the way for a longer and smoother Brexit transition, consequently, from last two weeks’ upswings so far has taken the pair beyond 23.6% Fibonacci retracements from the lows of October 2010 and 21EMA levels. Thus, we foresee northwards journey upto next stiff resistance at 151.803 levels.

Assuming the short-medium term spikes and the negative surprises are market tail risks in the long-term range in this pair.

Even if the aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility.

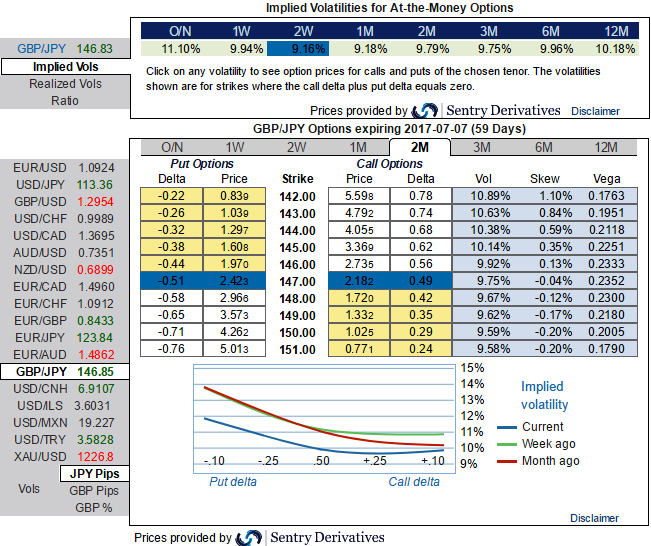

But further GBPJPY weakness and/or abrupt upswings suggests building a directional and volatility patterns at the same time: the value of OTM puts would likely to rise significantly as the IVs seem to be favoring these distant strikes. We, therefore, recommend shorting 2w IVs and buying IV skews of 2m tenors.

Please be noted that 1w ATM put options of this pair are priced in more than 24.89% whereas IVs of this tenor is just shy above 9.15%. Hence, the disparity between option pricing and IVs would be addressed by writing an OTM put option as stated in our below strategy.

Subsequently, since 2m implied volatilities are considerably spiking on higher side that is most likely to favor vega puts in the robust downtrend.

As a result, we believe in jacking up in long leg of the below option strategy:

Initiate longs of 2 lots of 2m at the money vega put options, simultaneously, short 1 lot of (1%) out of the money put of 2w expiry with positive theta. It is advisable to prefer European style options.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025