With continued USD weakens, USDCNY dipped to the 6.75 level this morning, i.e. back to the level seen in October. The PBoC set the USDCNY fixing rate at 6.7451, the lowest in nine months. Chinese authorities are again in control of their currency.

On the one hand, capital outflows have been easing due to administrative measures, and China has increased its holdings of US Treasuries for the fourth consecutive month, according to recent TIS data.

On the other hand, the market has gradually turned around their expectations and believes that the CNY weakness, if there is any, will be moderate. Of course, the market only has a very short memory, which means that it could easily forget what it had believed in the past.

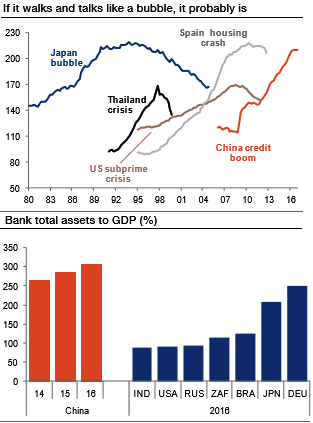

China is a source of angst for global investors with non-financial corporate debt at 166% of GDP compared with 97% a decade ago (refer above chart).

The bursting of a debt bubble in China would have far-reaching negative implications for emerging markets either via the risk sentiment channel or through commodity prices, global growth, and the global supply chain.

History tells us that credit booms lead to bubbles and to eventual crises. In China’s case, the risks are compounded by the large size of the banking system relative to GDP (refer above chart).

It is unclear if, or when, the bubble will burst in China, but it is the major medium-term risk factor for the entire EM currency complex.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data