USDCHF 3M3M FVAs: Owning USD/CHF vol appeals because it can benefit from the full gamut of risk triggers that can afflict all USD-vols, is a useful hedge overlay on a bullish Euro macro portfolio, and retains exposure to idiosyncratic CHF weakness of the kind seen recently, all without the threat of overt SNB management that can frustrate outsized sell-offs in EUR/CHF.

Geopolitical relief to pressure CHF. The North Korean missile test revived geopolitical tensions earlier this week, prompting market participants to bid the CHF and JPY (traditional safe-havens), mostly at the expense of the US dollar.

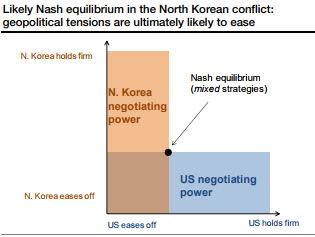

Through the prism of game theory, nuclear brinksmanship is a game of chicken (refer above graph), where the most likely equilibrium is that credible threats lead to a form of dissuasion. Assuming that the escalation between the US and North Korea will ease off, the Swiss Franc should sell off.

The technical analysts highlight that the USDCHF has bounced from the 0.9440 support and that breaking 0.9810 will trigger a greater recovery. The dollar hit a bottom.

Risk aversion pressured Treasury yields and the dollar, but US data releases surprised on the upside while the EURUSD appears to have overshot fundamental indicators, such as the real interest rate spread. After having tested the 1.2050 resistance, the EURUSD consolidation should extend further and benefit the USDCHF. Hence, optionality is recommended using fairly priced in calls.

Alternatively, the FVA format is motivated in part by the fact that USDCHF forward vols have severely lagged the surge in CHF-complex gamma, and partly by the mild inversion of the vol curve that ensures optically appealing flat slide/roll over time.

Admittedly some of the term structure shape is due to the forward starting 3M window covering the quiet holiday weeks of late December (3M3M = mid-November’17 to mid-February'18) that depresses 6M vol, but despite that, it may not be the worst idea to take delivery of and own USDCHF straddles through the first half of December that can reprise the above-average volatility of previous years around ECB and Fed meetings when tapering and rate hike decisions are expected to be announced. Courtesy: Societe Generale

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data