Despite the most likely US-China negative trade news, and the chances of a no-deal Brexit increased, amid such backdrop, although Aussie gained from 0.6722 to the current 0.6746 and Kiwis spiked from 0.6294 to 0.6315 level, these rallies appear to be sensing huge turbulence.

We encourage shorts in AUD and NZD vs JPY (put spreads) on the global growth and threat to risk markets. Uphold a short AUDNZD call. The downdraft in US ISM data this week, and the subsequent 28bp move lower in US short-end rates, reinforce keeping JPY longs against high beta AUD and NZD as global growth softness extends beyond the manufacturing sector. While that being said, we view this as an opportunity to reduce risk and book profit on our recent AUDUSD shorts ahead of upcoming US-China trade talks. Risks to the meeting seem tilted to one-side; a positive outcome and a handshake would surely see AUD rally, while a disappointment could trigger USD weakness through an unwind of dollar longs in conjunction with a US equity sell-off. But ultimately, with the trade war still a long-term issue and with global data still showing no signs of a clear floor, we remain broadly defensive and well-positioned for deepening risk- off move through late cycle hedges in AUDJPY and NZDJPY (JPY remains 20% cheap to 25y REER levels; AUD and NZD are roughly in line with averages).

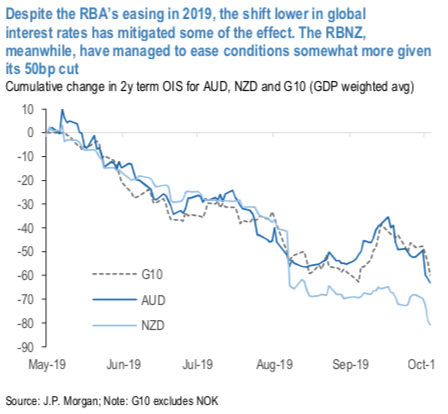

Furthermore, domestic factors in the antipodes add to our bearish conviction. The RBA cut this week as we anticipated, but added stronger policy bias and forward guidance in its statement. The RBA is also increasingly attuned to the downside risks from the global economy, particularly the offsetting lower rates elsewhere (refer 1st chart).

Accordingly, couple of economists continue to call for a February cut from the RBA but have shifted the risk bias to a November move, for which the rates market is currently underpriced (refer 2nd chart).

Meanwhile, inflation expectations continue to disappoint in New Zealand, despite Governor Orr citing this as a principle factor behind the RBNZ’s surprise decision to cut 50bps in August; this should keep the pressure on the Bank. We expect a cut to be delivered in November.

Finally, we sold AUDNZD to finance our AUDJPY put spread. Last week we remarked that AUDNZD screened slightly rich to relative rates, and the pair has partially closed that gap on the back of the RBA’s cut and new forward guidance. Going forward, volatility in the pair should stay tempered through a combination of two central banks that are both still firmly entrenched in their easing cycles, as well as offsetting directional responses following any change in global risk sentiment (such as news from the trade war).

Hold a 6m NZDJPY put spread. Paid 1.07% at the end of May. Marked at 1.68%.

Stay long a 3m AUDJPY put spread (72.0/69.5) part financed by selling a 3m 1.0975 AUDNZD call. Paid 0.38% during mid-September. Marked at 0.78%. Courtesy: JPM

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential