USDJPY OTC update:

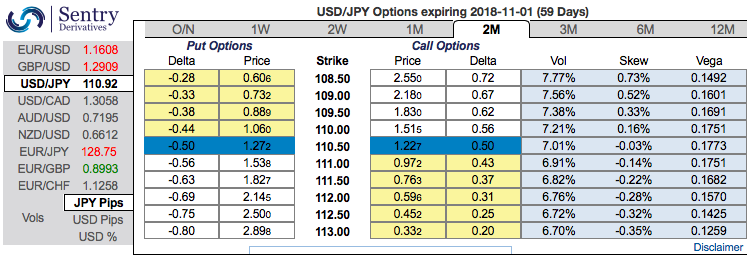

Please be noted that the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes upto 108.50 levels (refer above nutshell). While bearish delta risk reversal also substantiates that the hedging activities for the downside risks remains intact.

Accordingly, couple of days ago the debit put spreads have been advocated, wherein short leg is functioning so far as the underlying spot FX keeps spiking, we would like to uphold the same strategy on hedging grounds.

While both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies and bidding theta shorts in short run and 2m risks reversals to optimally utilize delta longs.

At spot reference of USDJPY: 110.946 levels, buy a 1M 111.880/108 put spread for 66 bps net premium indicatively (vols 7.4/7.6 vs 8.05 choice).

The maximum payout is 115bp, max payout/cost ratio is 3.2, and the put spread is 53% discounted to a standalone 1M 110.25 USD put/JPY call.

The rationale for the put spread structure is two-fold:

a) It takes advantage of the recent widening of short-dated risk reversals in favor of JPY calls to reasonably stretched levels adjusted for the level of ATM vol (refer above chart).

USDJPY 1M 25D risk-reversals currently imply a spot-vol correlation level of around -38%, which is not a historically high bar for realized spot-vol correlation to beat but is nonetheless expensive vis-à-vis recent delivered numbers (2-wk +25%, 1-mo +10%) and supportive of skew selling option structures such as put spreads; and

b) The extent of any potential yen strength from here is likely to be capped in the fundamental view, specifically after the knee-jerk decline in USDJPY spot late last week.

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at 30 levels (which is bullish), while hourly USD spot index was at 27 (bearish) while articulating at (08:06 GMT). For more details on the index, please refer below weblink:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close