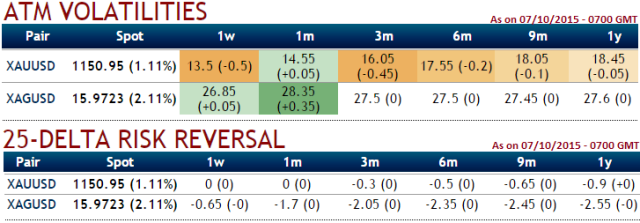

The downtrend in bullion market has been persisting and we can urge this hundred times as the negative delta risk reversal numbers shown in the above nutshell suggests downside hedging in long term has been relatively expensive which means anticipation of gold prices to fall further. The bearish signal stands robust on monthly moving average as well considering the previous trend analysis. RSI and slow stochastic curves are not substantiating weekly upswings. Any time long lasting downtrend may resume again.

From the above table you can observe the delta risk reversal has been neutral but shifted into red zone again for 3 months contracts with increased volatility. Further the positions constructed for bull overview will increase in value with time decay. But for now rate hike is almost deferred and what do you think can be the impact on gold?

Option Strategic Framework: Diagonal option strips (XAU/USD)

Buy 15D At-The-Money delta call option and buy 2 lots of 1M At-The-Money put options either at current point of time or after squaring off calls. This strategy involves buying a number of ATM calls with shorter expiry to be in a safer side if any abrupt swings arise here after and double the number of puts with long term expiry contemplating our bearish anticipation and fed's rate speculation are also on the table.

On 1st October we advised 15D delta call, that is the day the rebound has started from the lows of 1110.99 to the current prices of 1151.93. So the current spikes can give the opportunities for profit booking at current levels for risk averse. However, aggressive traders can still hold for some more upside potentials maximum up to 1175 levels. Risk averse traders can wait for the dips back again with their active ATM puts with longer expiries.

FxWirePro: Aggressive gold traders can clutch long calls on strips, risk averse can book profits

Wednesday, October 7, 2015 11:33 AM UTC

Editor's Picks

- Market Data

Most Popular